Page Topics:

Escapes

Introduction

Escapes are created in order to collect taxes on properties that were unknown or improperly taxed in years preceding the current collection year. Situations that might require escapes include improvements that the county was not aware of, parcels that went unpaid in the previous year but could not be sold in tax sale, or taxpayers having paid taxes based on undeserved exemptions.

Escapes can tax up to five years prior to the current collection year. They can be created from the time one collection year is settled until certified mail is sent for the next collection year. Beyond that point creating escapes might leave a parcel unpaid but without the possibility of sending it to tax sale.

Creating an escape for any given tax year does not alter the record of that tax year. Capture does not allow changes to records prior to the current abstracted year. As such the system does not require appraisal information to be entered for the calculation of escape taxes. Only the assessment and penalty information must be entered.

Simple Case

The following steps describe adding three years of escaped taxes to a parcel.

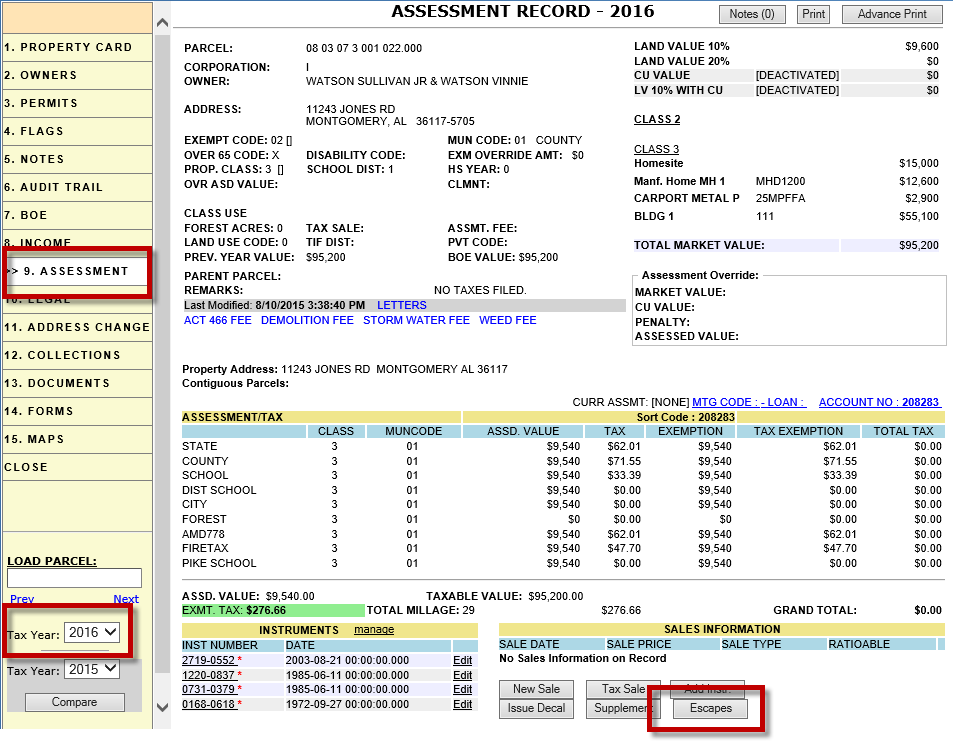

1. Open the Property Card and change the tax year to the prior year (current collection year).

2. On the Assessment Tab, click the Escape button.

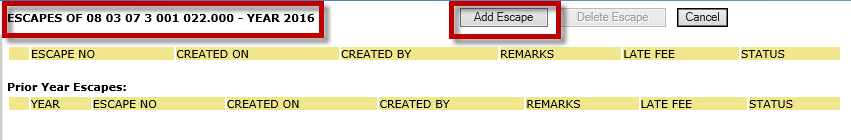

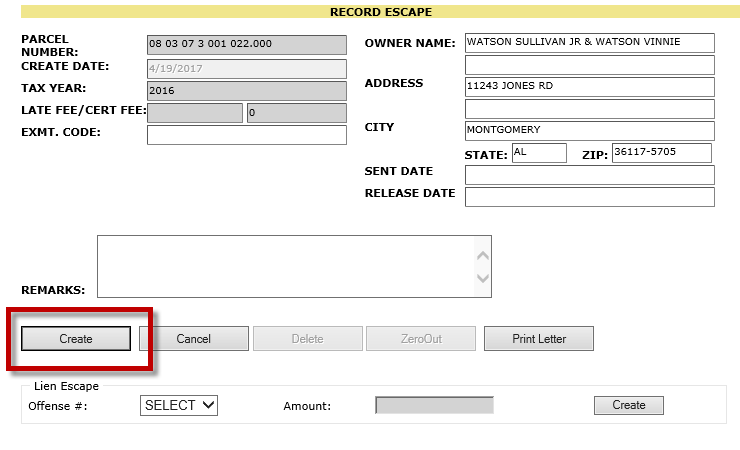

3. On the create Escapes Of page, click the Add Escape button. On the following page verify the owner name and address, enter any remarks needed, and click the Create button.

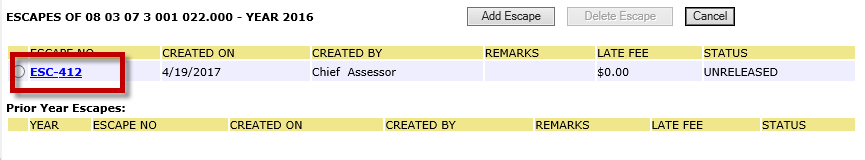

4. On the Escapes Of page click the escape number that has just been created.

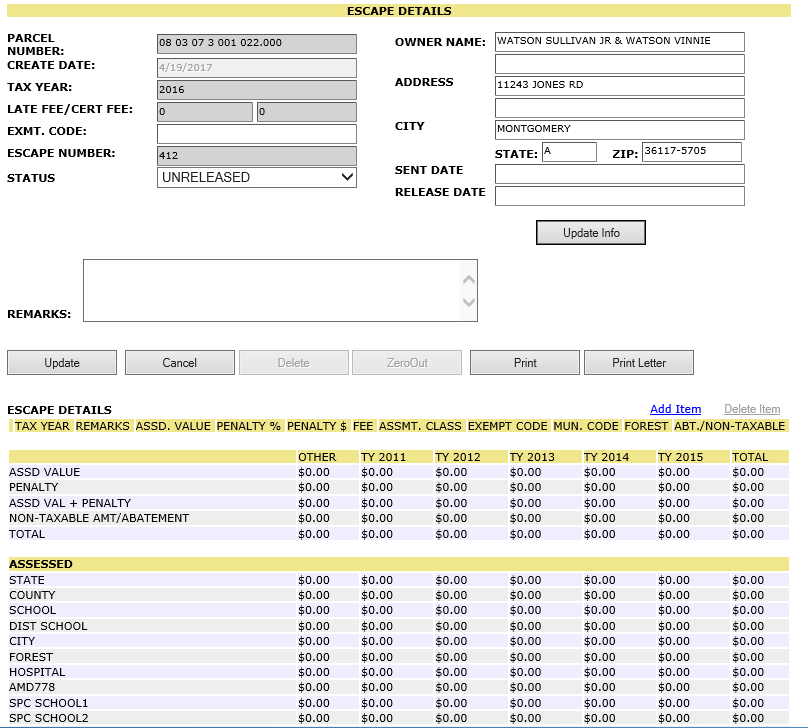

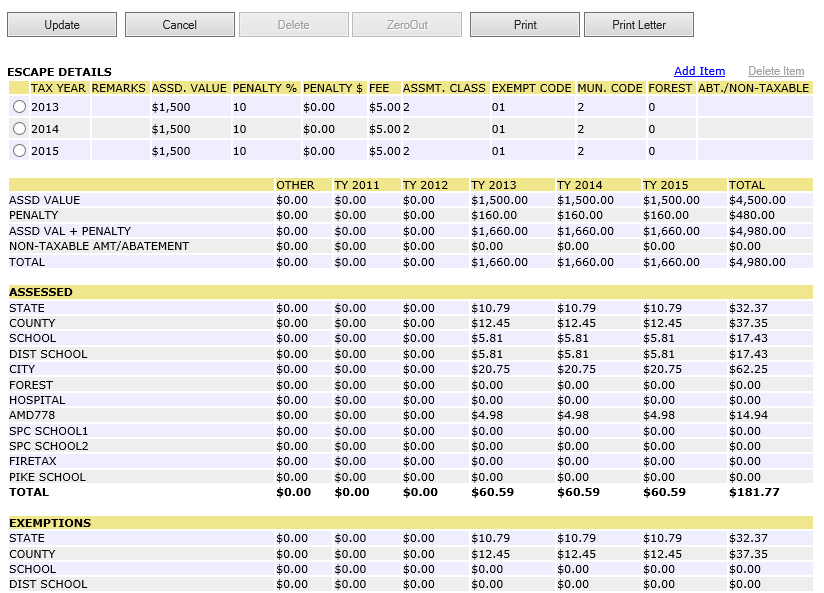

The Escape Details page shows a complete breakdown of taxes for all years that can be entered. The numbers will be filled in as items are added to the escape.

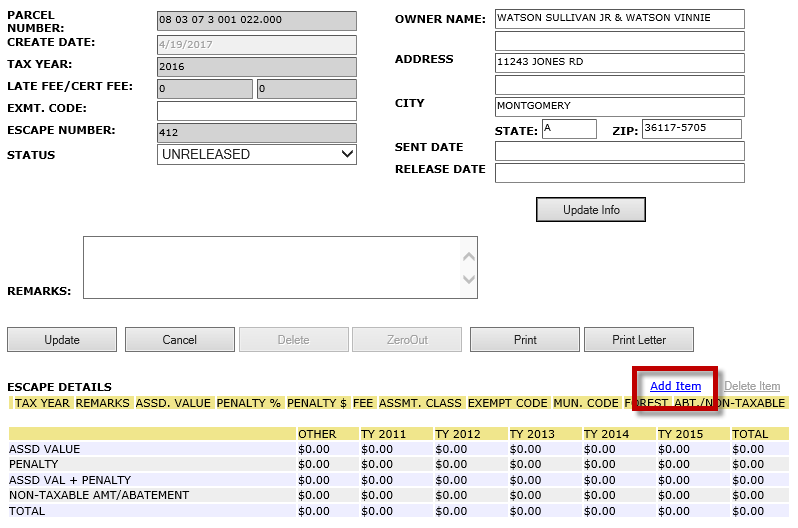

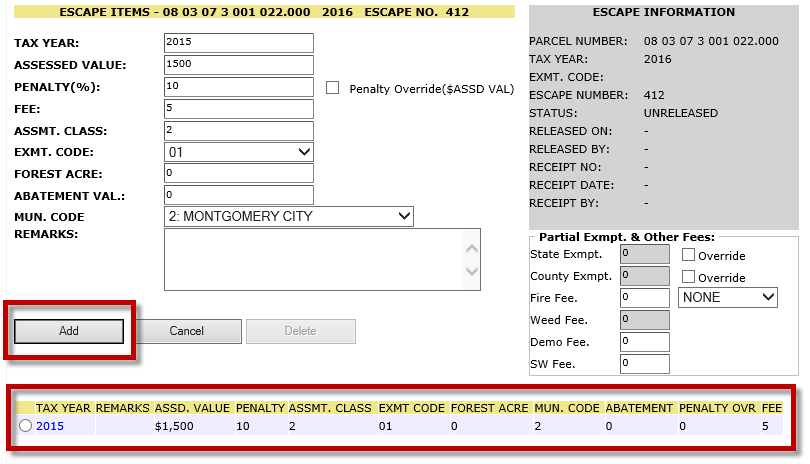

5. Click the Add Item link to access the ESCAPE ITEMS page.

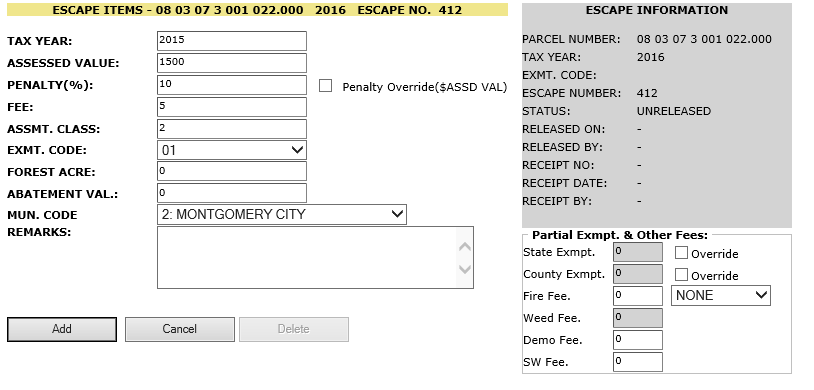

6. Enter the information for the first year to be escaped. Note that tax amounts are not entered directly, but are instead calculated based on the Assessed Value, Exempt Code, and other information entered.

The Penalty (%) field is used by default to enter a penalty as a percentage of the assessed value. To enter an absolute value to be added to the assessed value, click the Penalty Override ($ASSD VAL) checkbox.

7. Click Add to add the first year’s assessment. The listing will appear in the section below the Add and Cancel buttons.

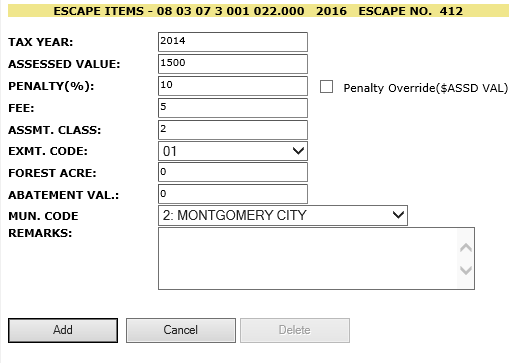

8. After adding an item, the information will remain in the text boxes. Change the tax year to the second year to be added and click the Add button.

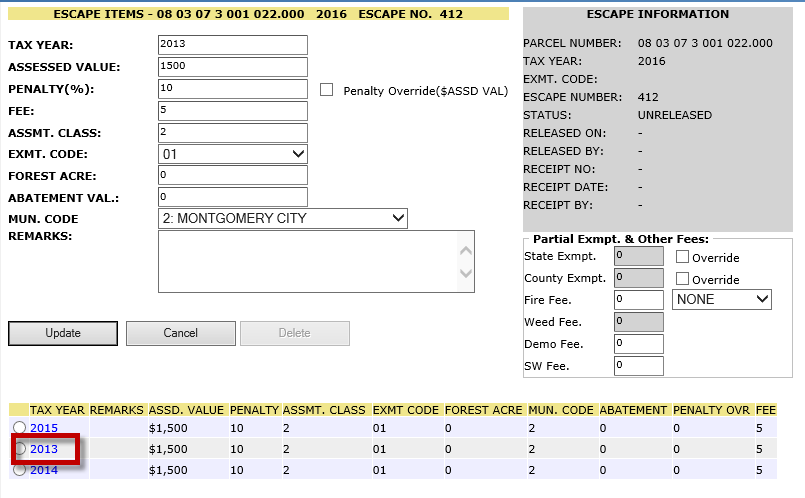

9. Update the information for a third year and click Add.

10. To update one of the escape items click the Tax Year on the listing. The information related to that item will be populated in the fields above as it was entered. Click update to save changes.

11. Click Cancel to exit the page.

12. Review the tax information on the Escape Details page. If further changes are required click Add Item to return to the Escape Items page. From there add, update, or delete escape items as needed.

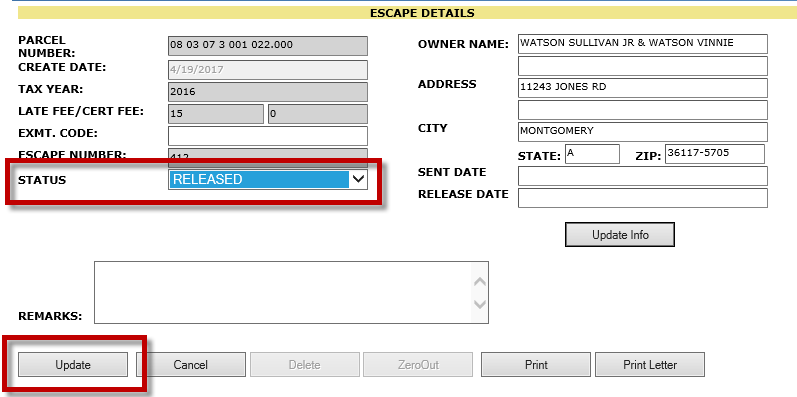

13. To release the escape to collections, change the Status drop-down to RELEASED and click Update.

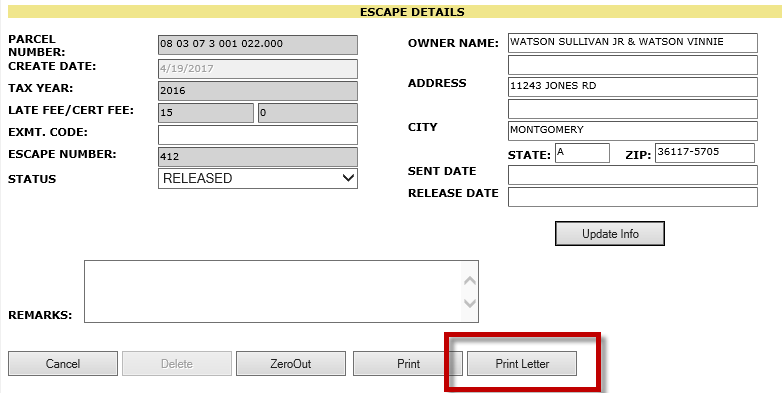

14. Click the Print Letter button to create a letter to be sent to the taxpayer.

Creating Receipts

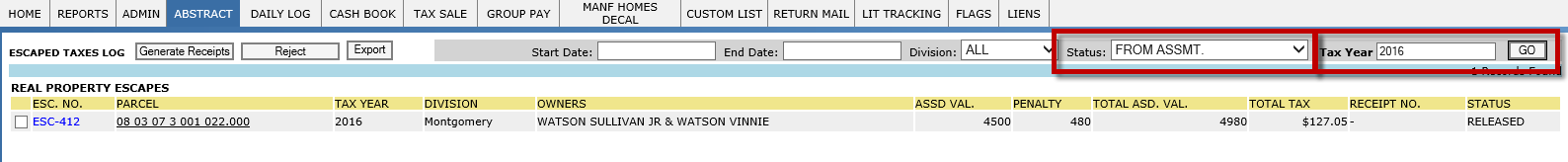

After an escape is released, the collectors will need to generate the receipt manually. Those escapes requiring attention will be found listed on the ESCAPES page with a status of FROM ASSMT. The collectors can review the escapes from this list and generate receipts or reject them as required.

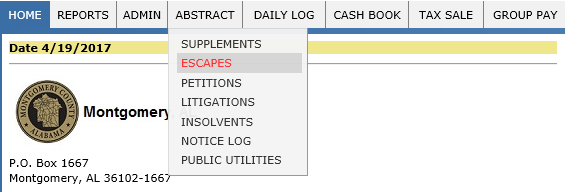

1. In the Collections workspace, hover the ABSTRACT tab and select ESCAPES.

2. Set the Status drop-down to FROM ASSMT, and the Tax Year to the current collection year.

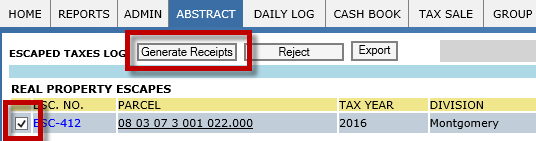

3. Checkmark the parcel and click the Generate Receipts button. Confirm in the dialog box that appears.

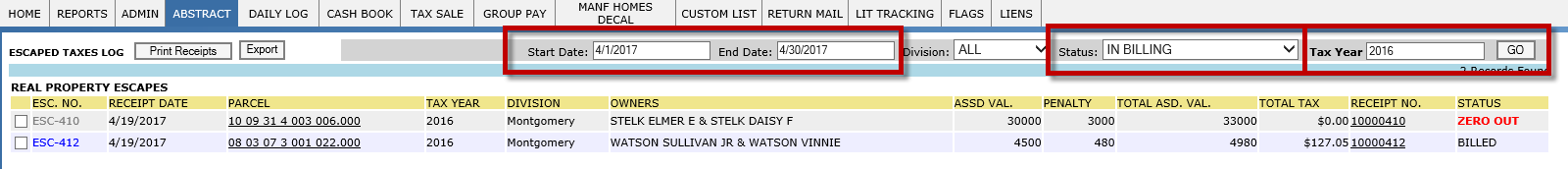

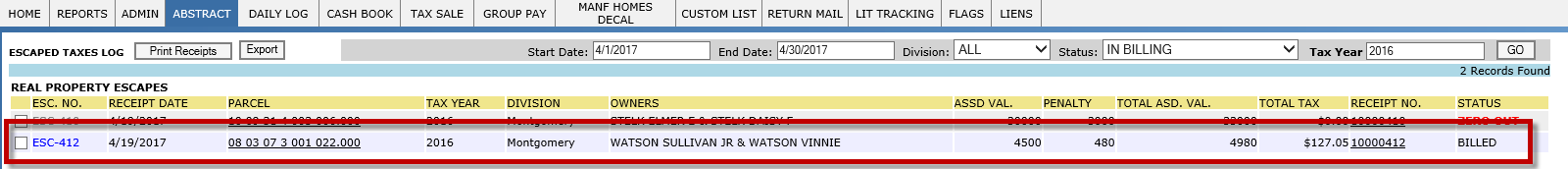

4. Change the Status drop-down to IN BILLING and set the Start and End Dates to the date of the supplement. Click GO.

5. The parcel will be listed along with its new receipt number and pertinent information. Click the Receipt # to access the Single Pay screen.

If the receipts were automatically created when the parcel was released, the parcel will still appear on the Escapes page under the IN BILLING status. The new receipts can also be accessed from the Parcel Dashboard.

Escape Receipts

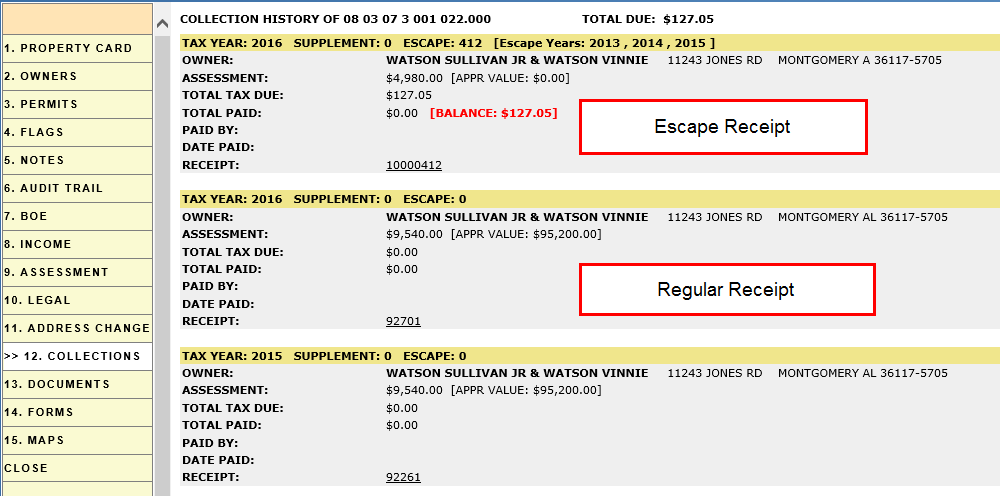

Escape receipts do not replace or add to a parcel’s regular tax receipt. If looking at the receipt dashboard, the History page will show both the escape receipt and the regular tax receipt.

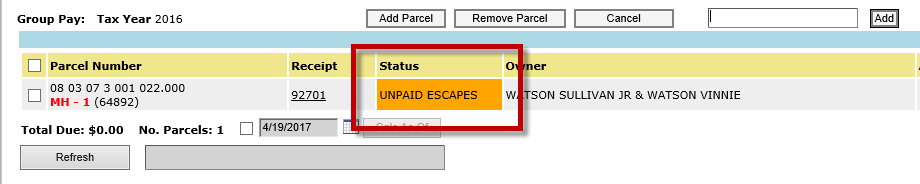

If the regular tax receipt is added to a group pay, a warning will appear on the parcel indicating that there is an unpaid escape. This indicates to the collector that they must bring the escape receipt into the group pay as well to ensure it is paid.

Deleting an Escape

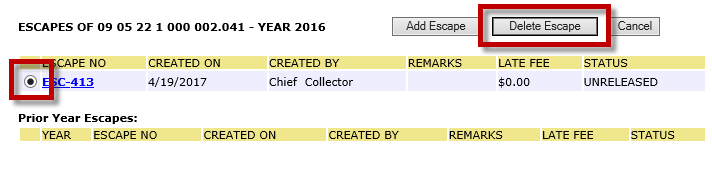

If an escape is created in error it can easily be deleted. If it has not been released it can be deleted from the Parcel Dashboard on the ESCAPES OF page. Just click the radio button beside the escape, then click Delete Escape.

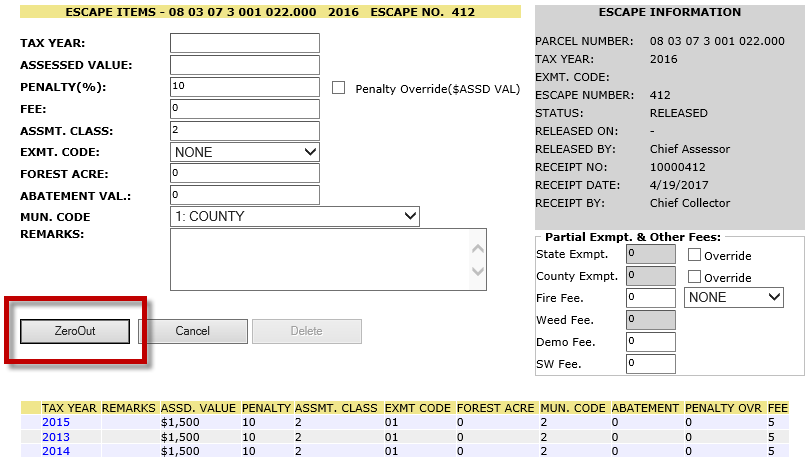

If the escape has already been released it must be zeroed out. Access the Escape Items page either through the parcel dashboard or click the ESC. NO link on the ESCAPES page where all released escapes are listed. Once there click the ZeroOut button to set the escaped taxes to zero and make the receipt unpayable.

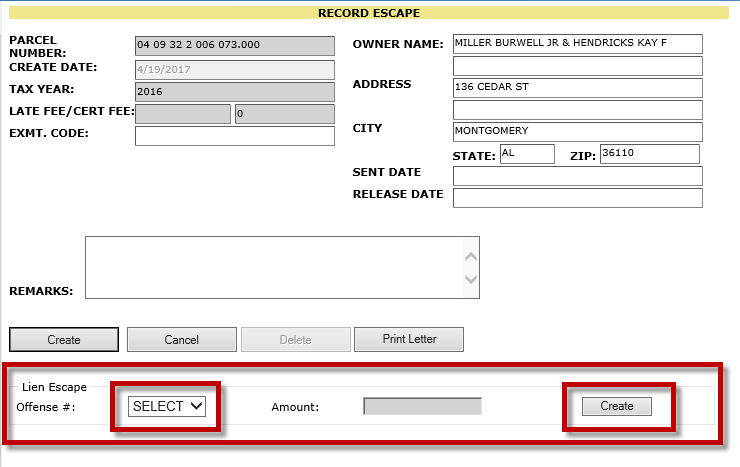

Lien Escape

Capture can be set up to import Weed Liens and other city fees as they are created. These are not automatically added to the tax bills as this would complicate the tracking of the fees. Instead, if the fee must be collected immediately, Capture allows the creation of a Lien Escape. When initially creating the escape, the user will select an Offense # from the drop-down and click the secondary Create button. An Escape receipt will be created specifically for the selected fee.