Page Topics:

Mass Updates

Introduction

This Reports will give a detail information about each action performed during Business Personal Property – Mass Update in Capture to Users. A report is a document that presents information in an organized and in Summarized format for all Users (Privileged) and its Purpose. This PP– Mass Update Reports are used for keeping track of information.

Worklfow

First Login as privileged User to Perform PP – Mass updates.

Click on Personal Property tab.

Here, the user can Mass Update the status of Returned Rendition notices with respective Owner, Tax Year and Rendition Date. The User can Mass Address change by selecting the multiple Parcels. The User can Mass Import all the accounts which has Lessee information. The User can Mass Regenerate by selecting the respective accounts to Regenerate new values based on depreciation cycle and percentage. And, the User can Mass Replace the PP Accounts with respective Owner name and Tax Year.

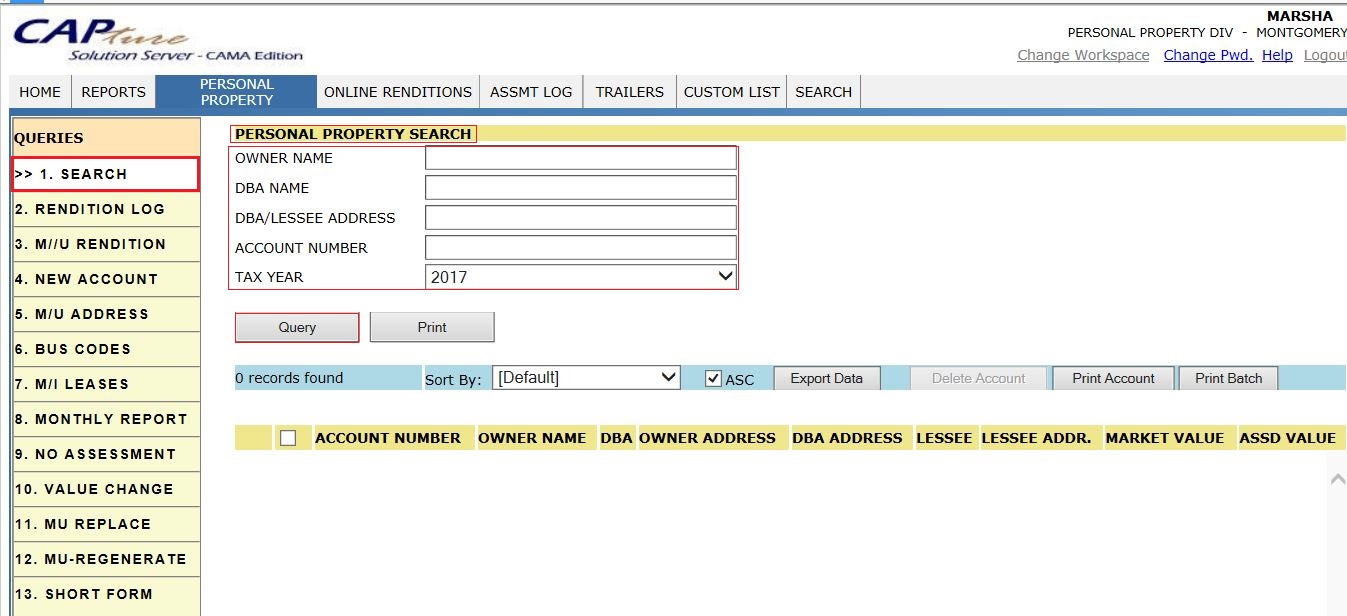

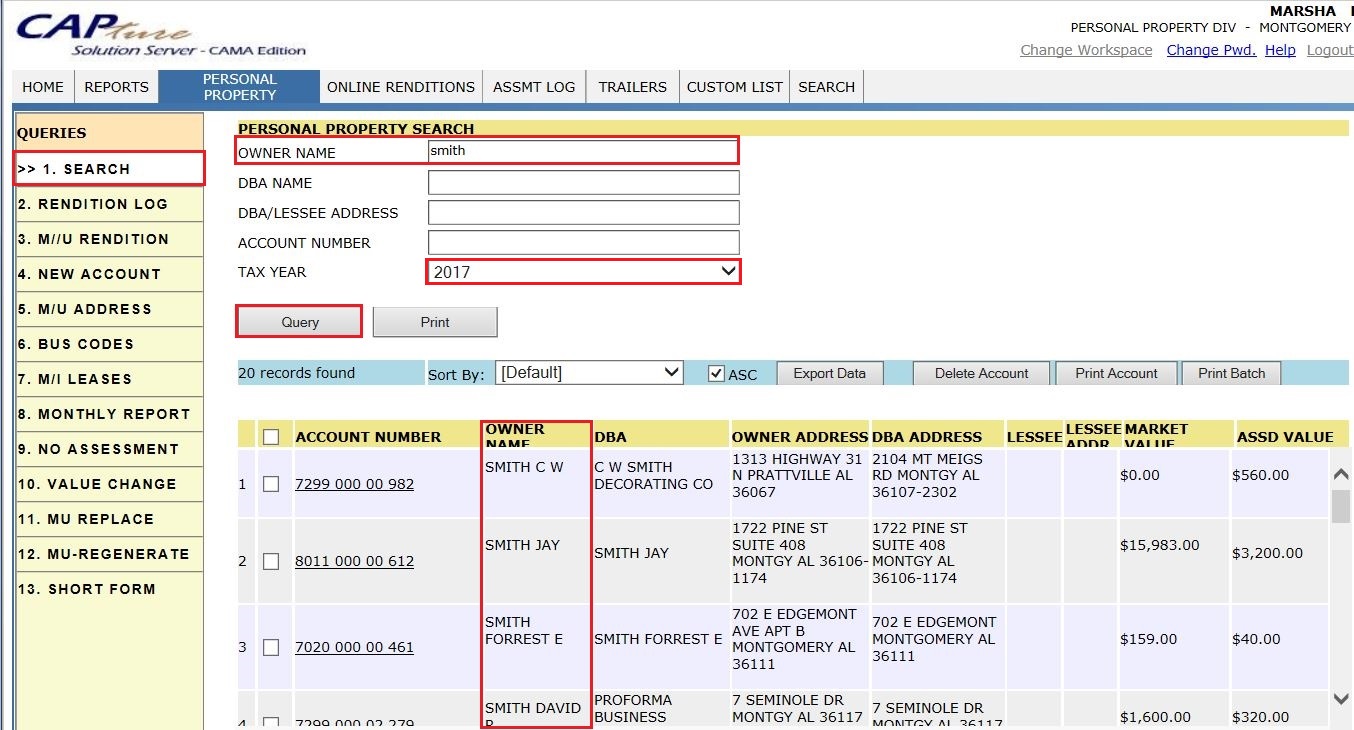

Report -1: SEARCH

Navigation: PERSONAL PROPERTY à SEARCH

This Report is Used to Search the Records of Personal Property based on Tax Year & input provided by the user like Owner Name, DBA Name, Account Number.

Following screenshot shows the records of 2017 Tax year regarding Owner Name.

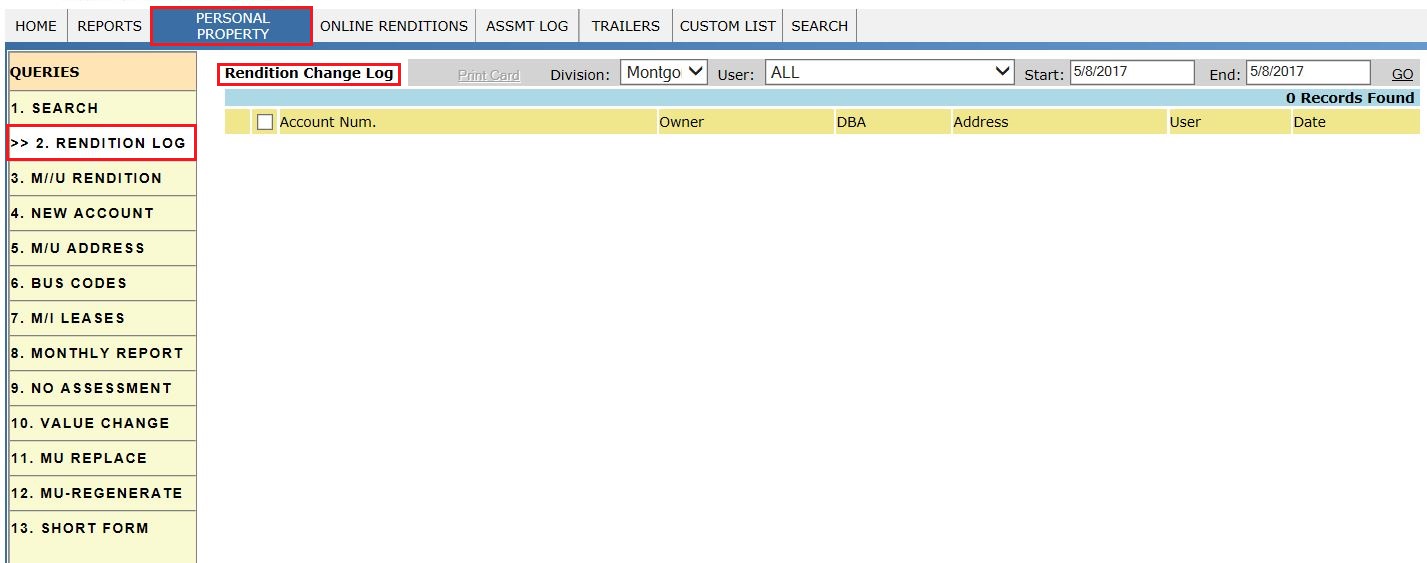

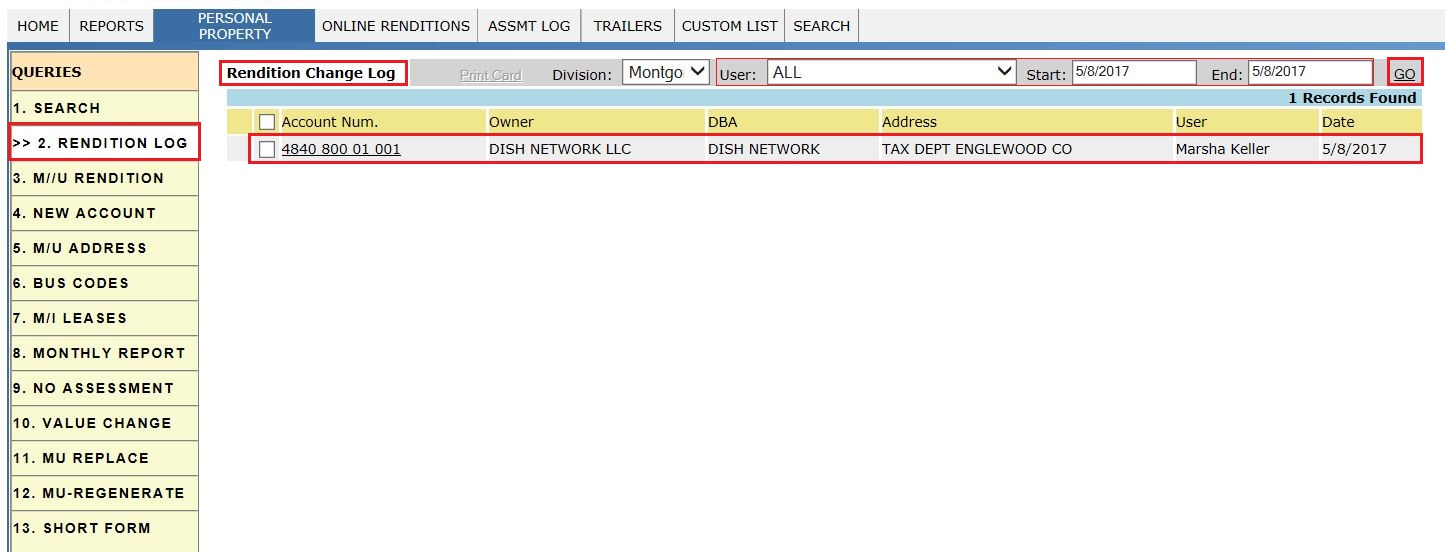

Report -2: Rendition Log

Navigation: PERSONAL PROPERTY à Rendition Log

This Report Contains all the Rendition Notices Received by the County with respect to User, start date & End date.

User can Filter the Records by selecting User names, Start date & End date.

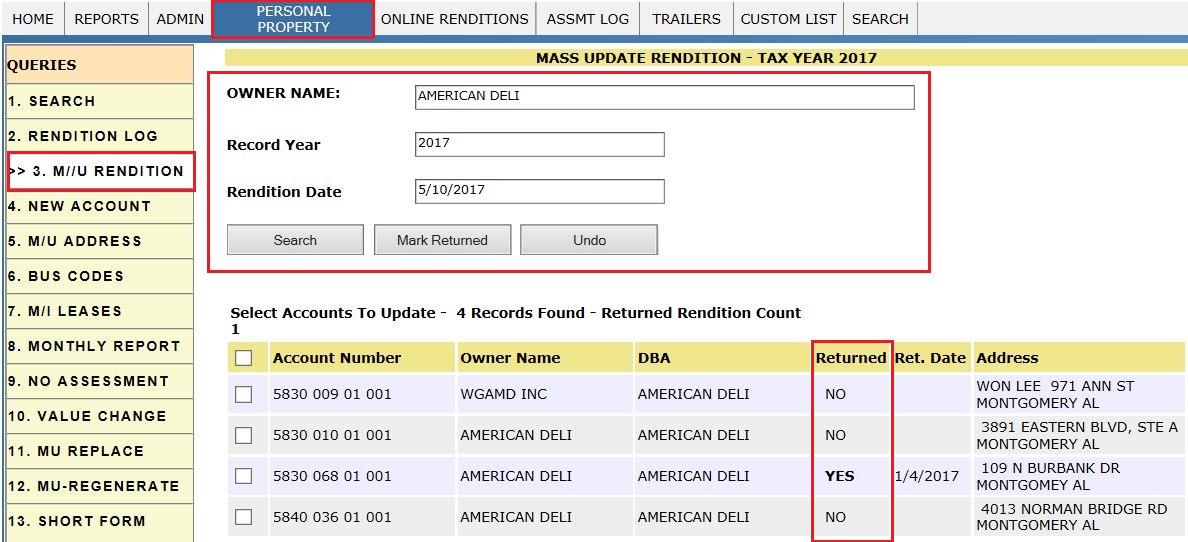

Report - 3: M/U RENDITION

Navigation: PERSONAL PROPERTY àM/U RENDITION

This Report is used to Mass Update the status of Returned Rendition notices with respective Owner, Tax Year and Rendition Date.

Click on M/U RENDITION Tab, and fill the respective details like Owner name then click on Search button, which gives respective Business Accounts details of that owner with retuned status Yes/No.

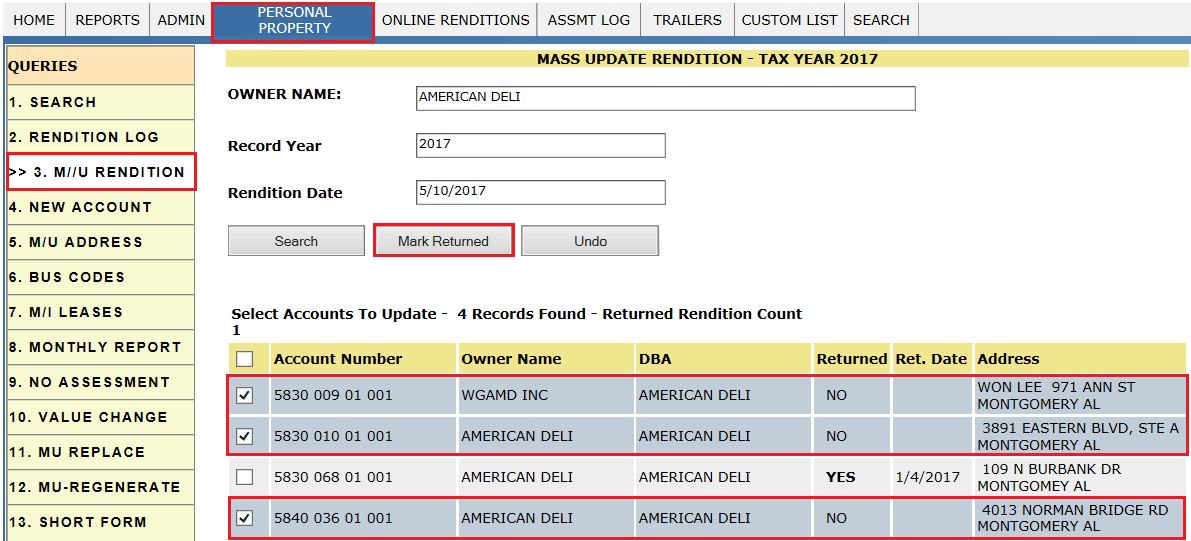

User can Mass Update the Rendition Returned Status – ‘No to Yes’ by selecting the respective records and then click on Mark Returned.

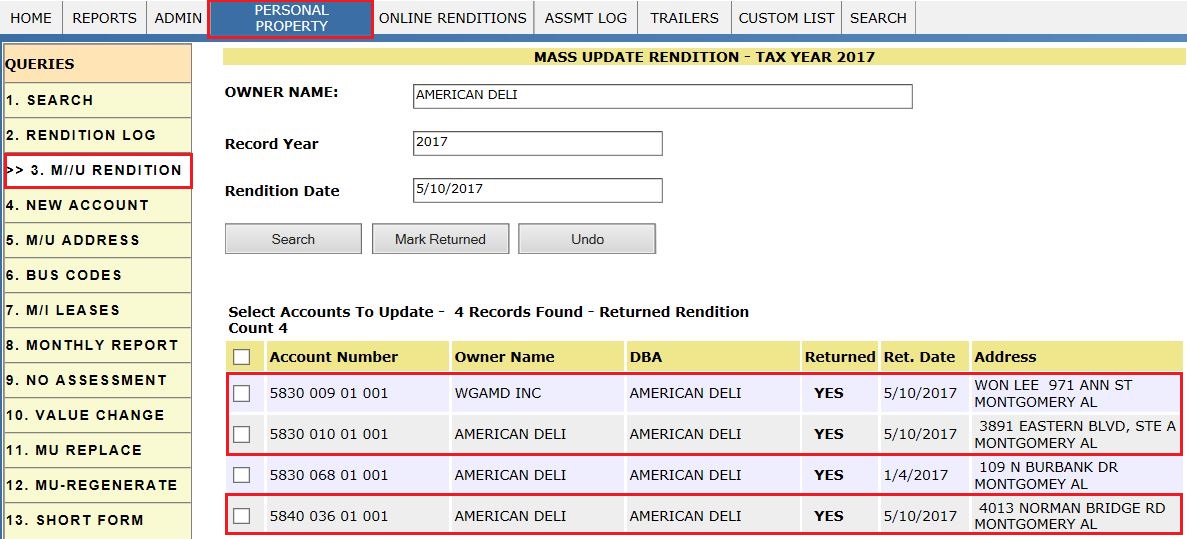

After Clicking on Mark Returned, the Returned Status will change from No to Yes.

Note: This Mass update is done for owner who have multiple businesses.

If the Returned status is YES (Returned), User can modify to NO By using Undo button or can Update to same YES , for that Account the date change to current Date itself.

Report - 4: NEW ACCOUNT

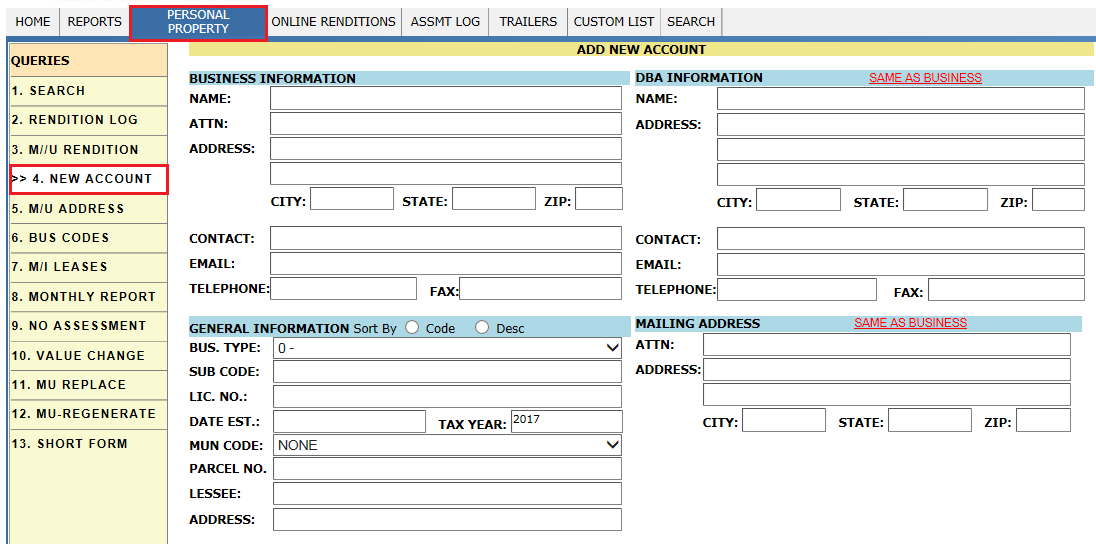

Navigation: PERSONAL PROPERTY àNEW ACCOUNT

Adding New Business Account:

To add new business personal property account, Login as privileged user (Personal Property user) and click on PERSONAL PROPERTY. In that, click on NEW ACCOUNT. It will display Add New Account window.

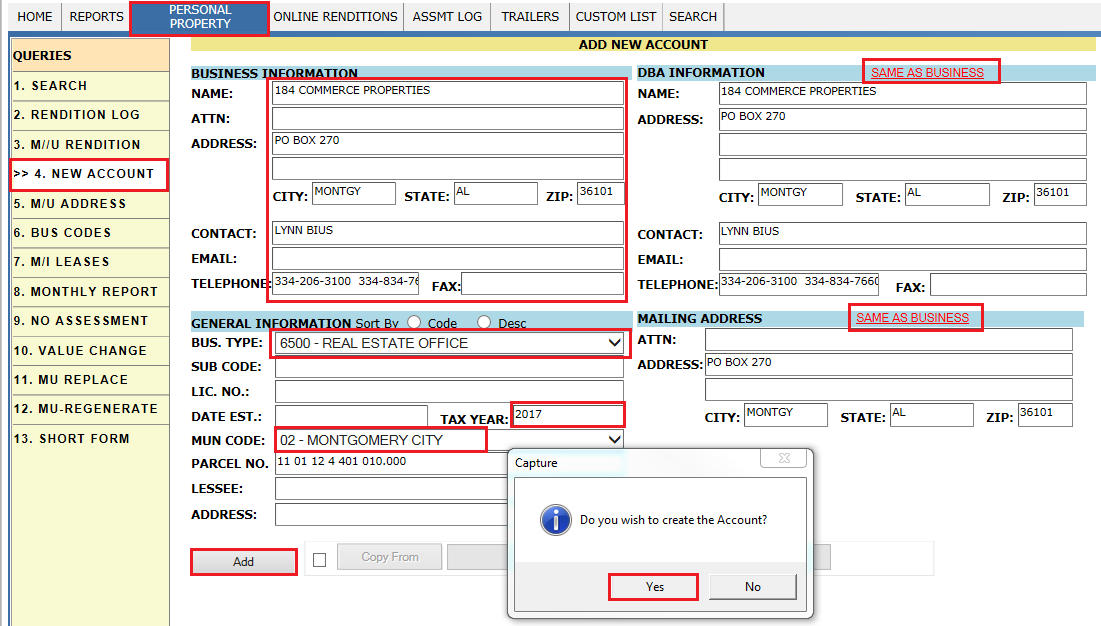

Fill the Business information, DBA information (If it is same as business info click on SAME AS BUSINESS) and General Info like Business type and Municipality code. Then click on Add button.

Note: To add new business account from the existing account (same business type), check the Copy From check box and enter account number from which all the account information (items, owner and DBA information) should be copied.

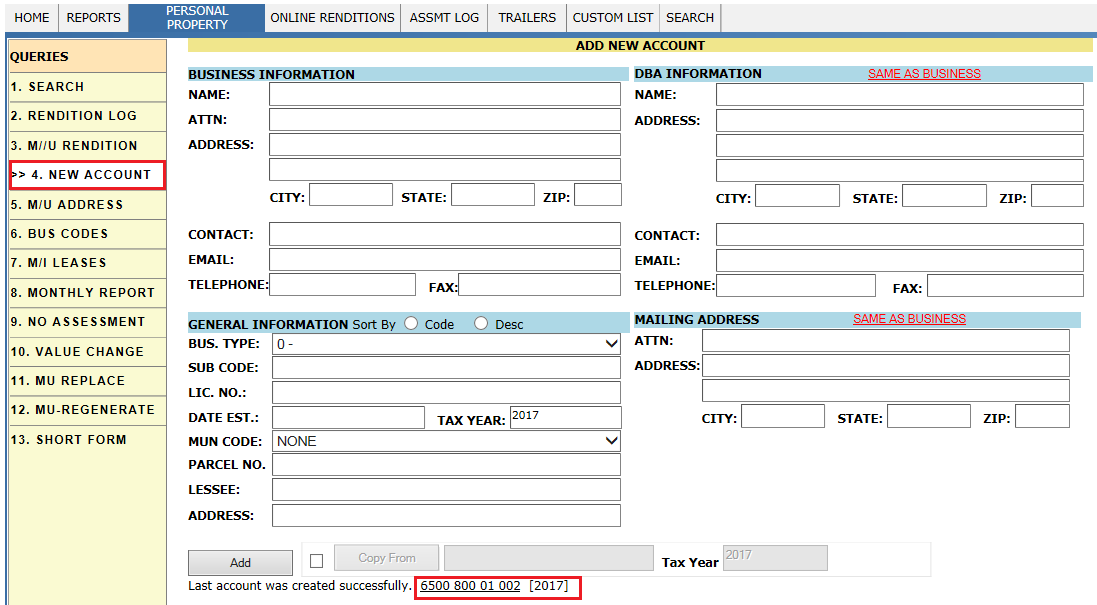

This will create an account for current year (also for future year but not for previous years) with link. By clicking on the hyperlink will open the account dashboard. Verify audit Trail after creating an account.

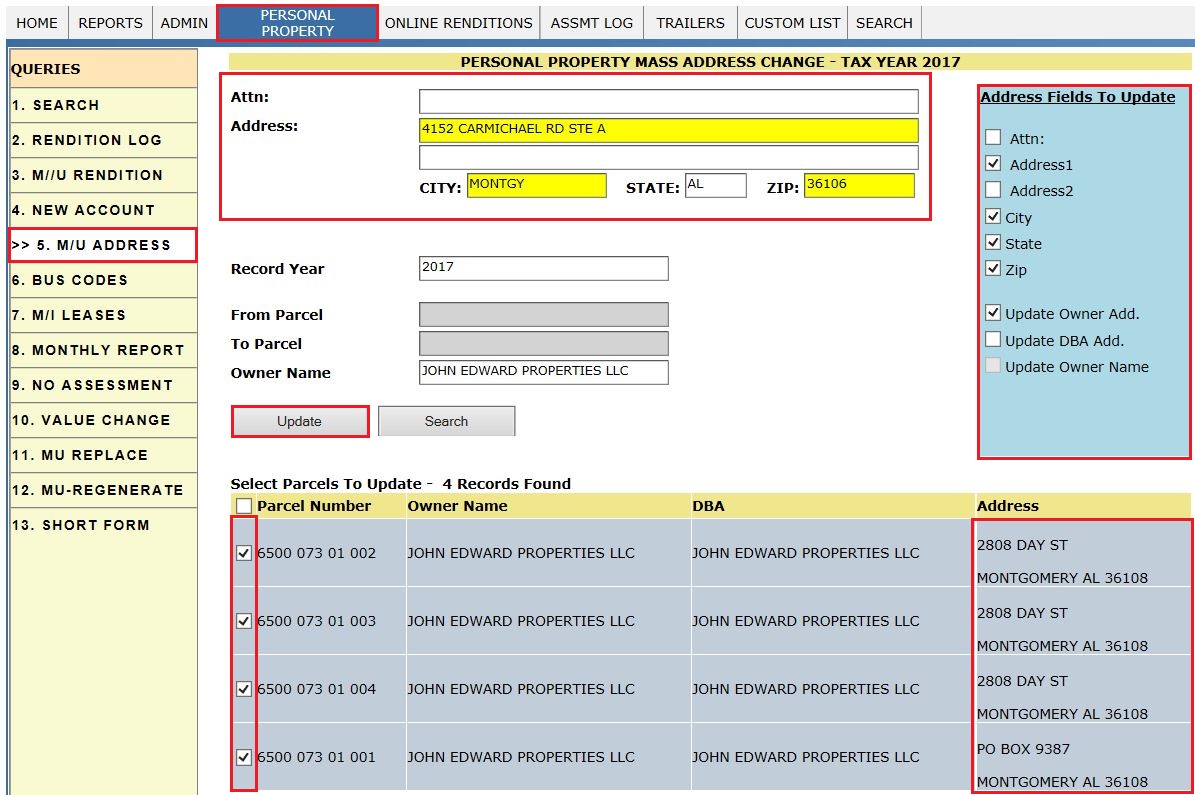

Report - 5: M/U ADDRESS

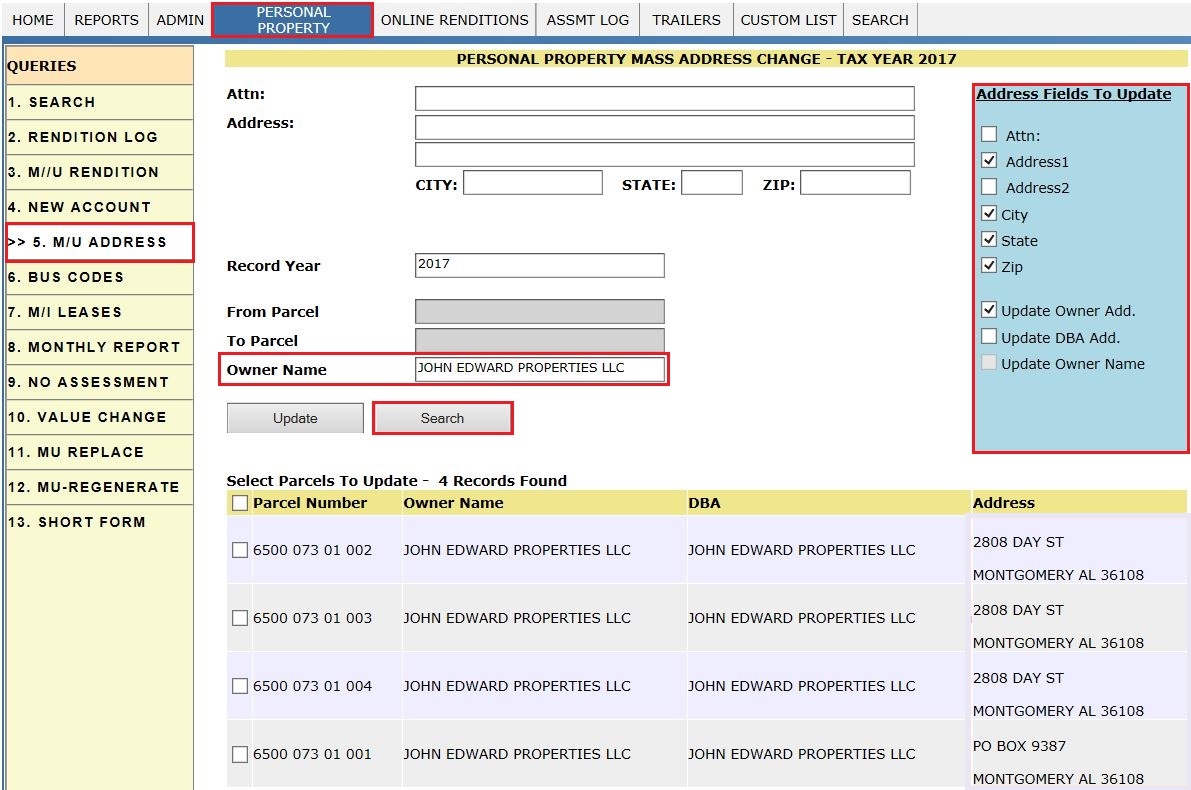

Navigation: PERSONAL PROPERTY àM/U ADDRESS

This Report is used to Mass Update the Address of selected Accounts/Parcels with respective Owner.

Click on M/U ADDRESS Tab, and enter Owner Name then click on Search button, which gives respective Business Accounts details of that Owner with respective DBA and Address.

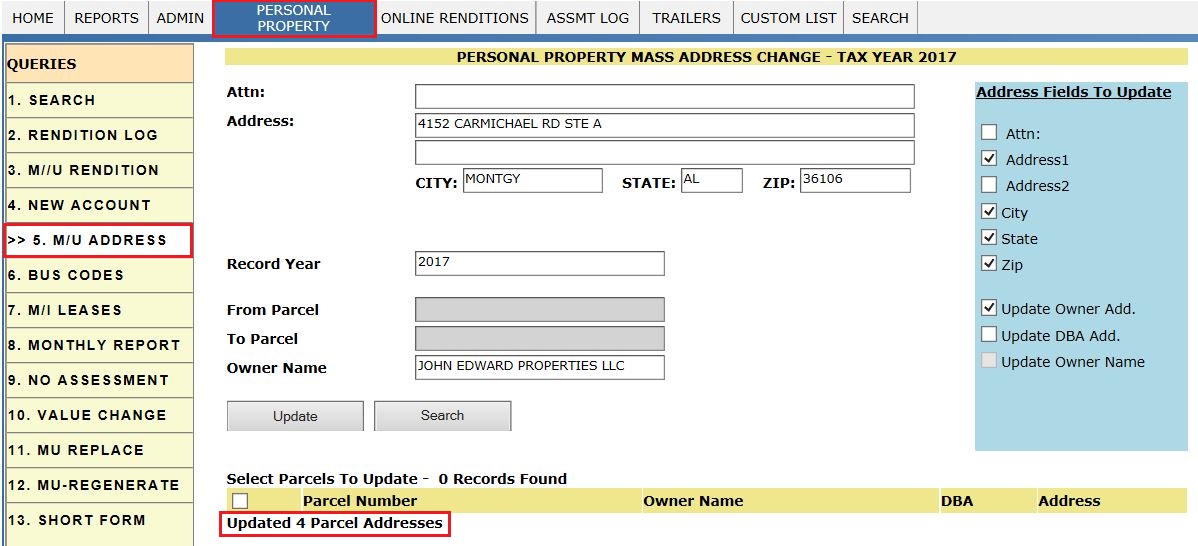

User can Mass Update the New Address by selecting the respective fields to Update & then click on Update Button.

After Updating the new Address, the respective Accounts/Parcels will get updated to new Address.

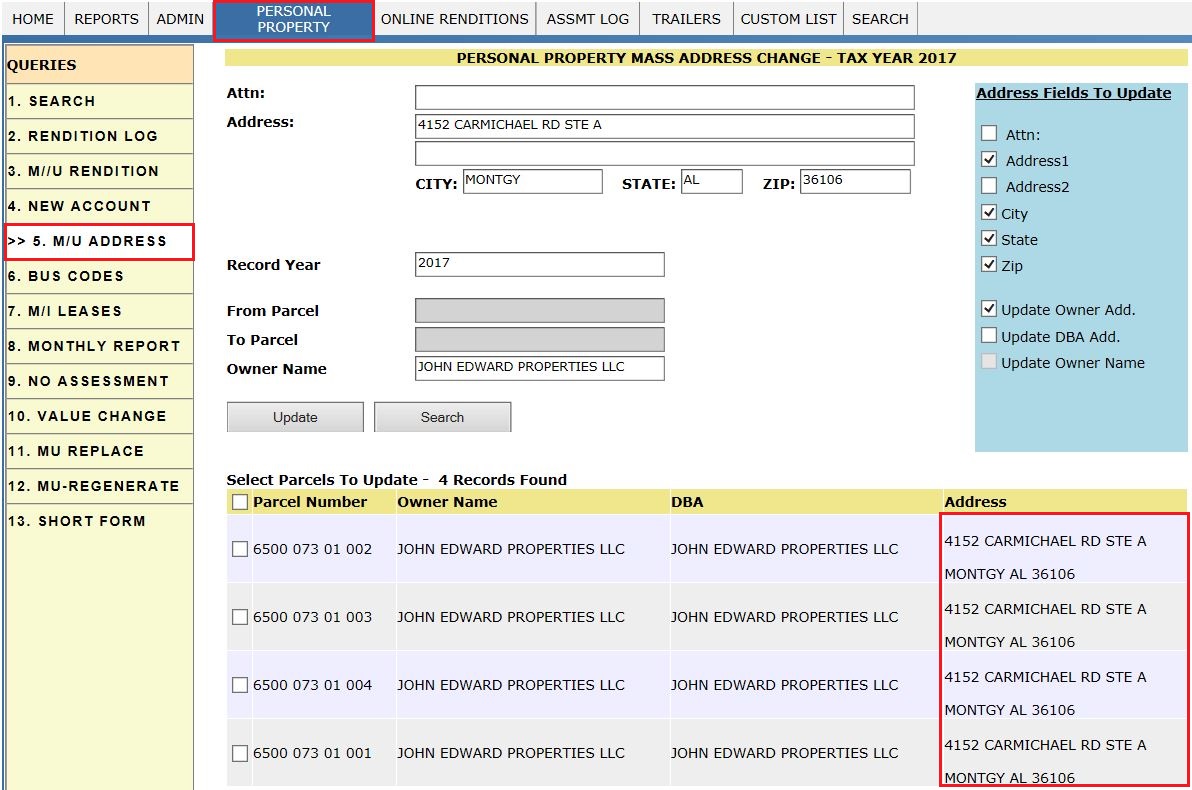

Updated Accounts/parcels with New Address.

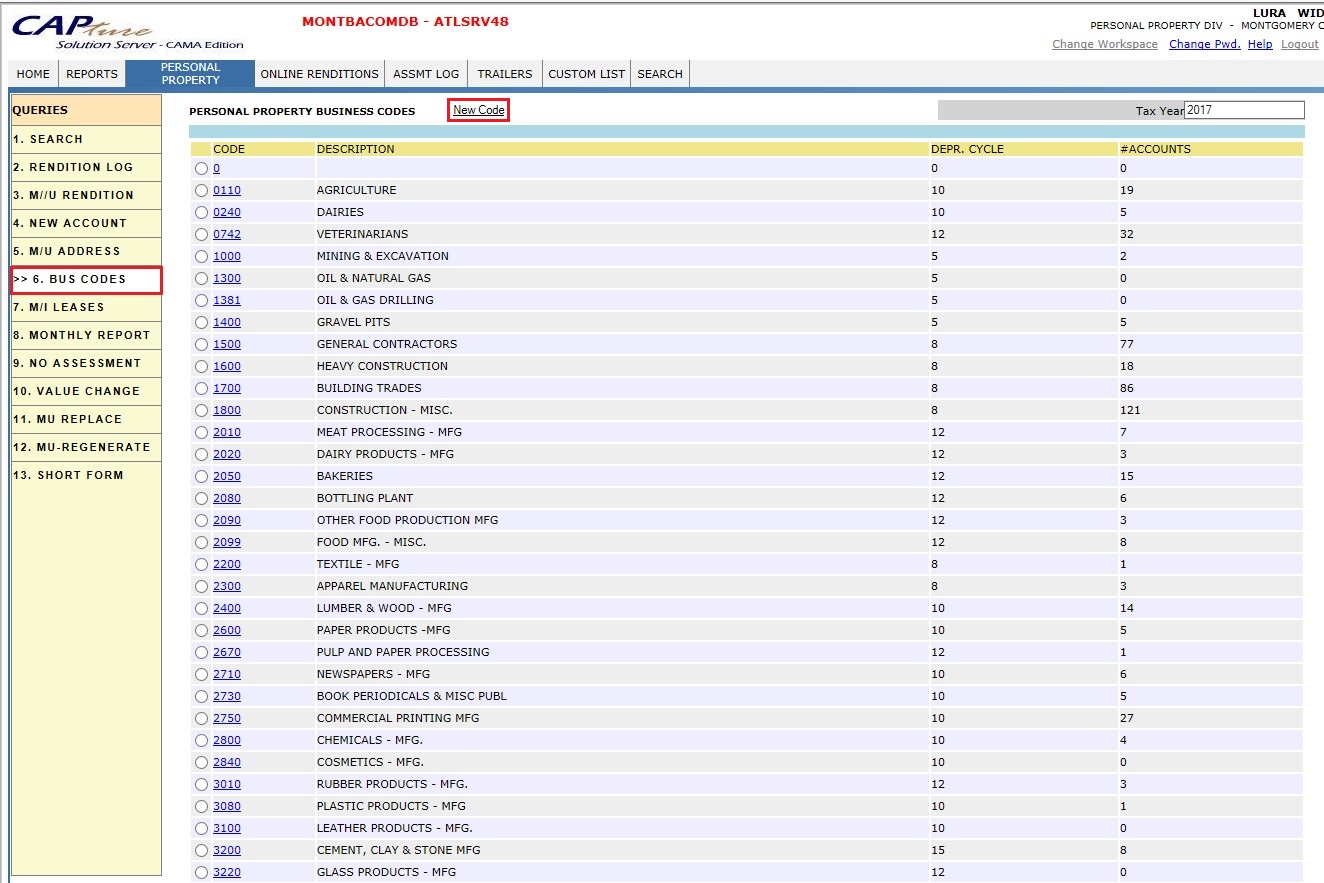

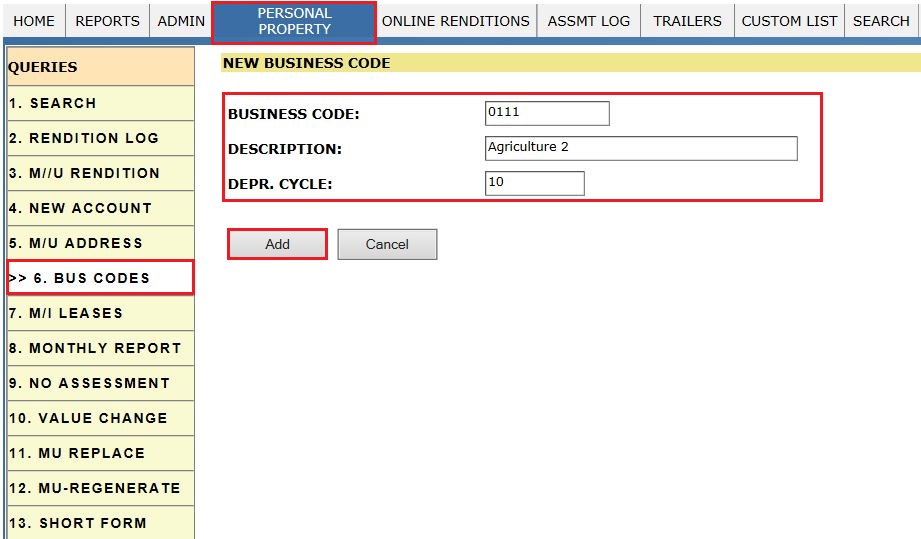

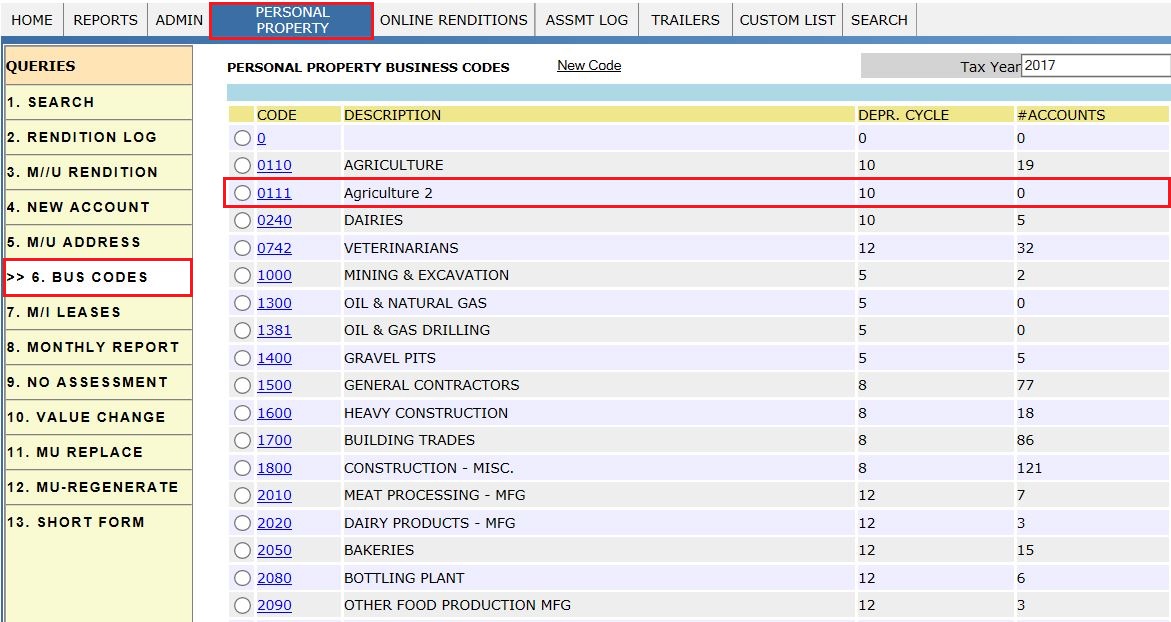

Report -6: BUS CODES

Navigation: PERSONAL PROPERTY àBUSCODES

This Report is used to Identify the Type of Business with reference to Business CODES & other Details like Description, Depr. Cycle & No. of Accounts with respect to Tax year.

Here, User can add New Codes if required. For adding click on New Code Hyperlink as shown in above screenshot. Then enter the required details, click on Add button.

After adding the Business Code, it will get Updated as shown below.

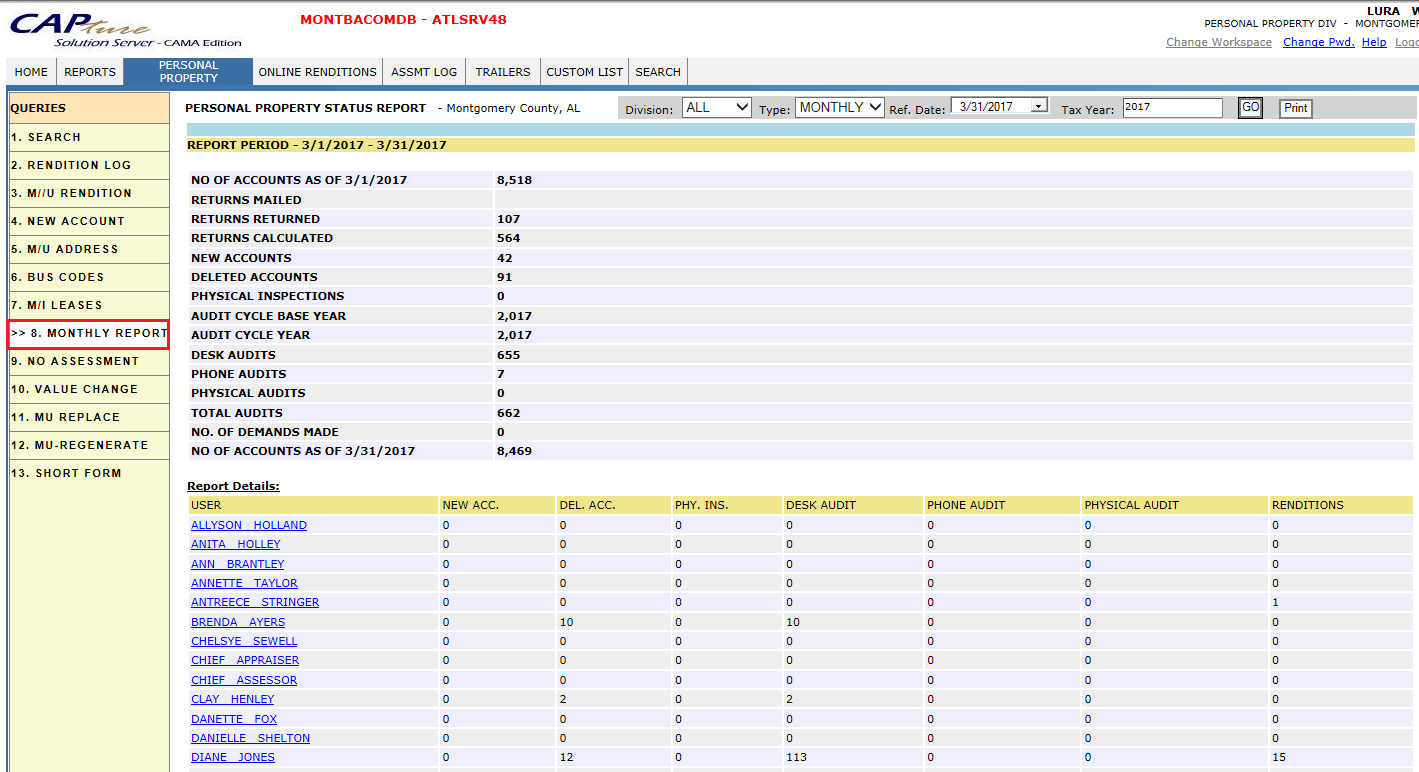

Report -8: MONTHLY REPORT

Navigation: PERSONAL PROPERTY à MONTHLY REPORT

This Report shows all the information about Renditions for specific Month with respect to User. In this PP Status Report contains like No. of Accounts, New Accounts, Deleted Accounts etc. on Monthly basis.

All users can track their specific status report like how many new accounts are created, deleted, Renditions etc. are done in the specific month

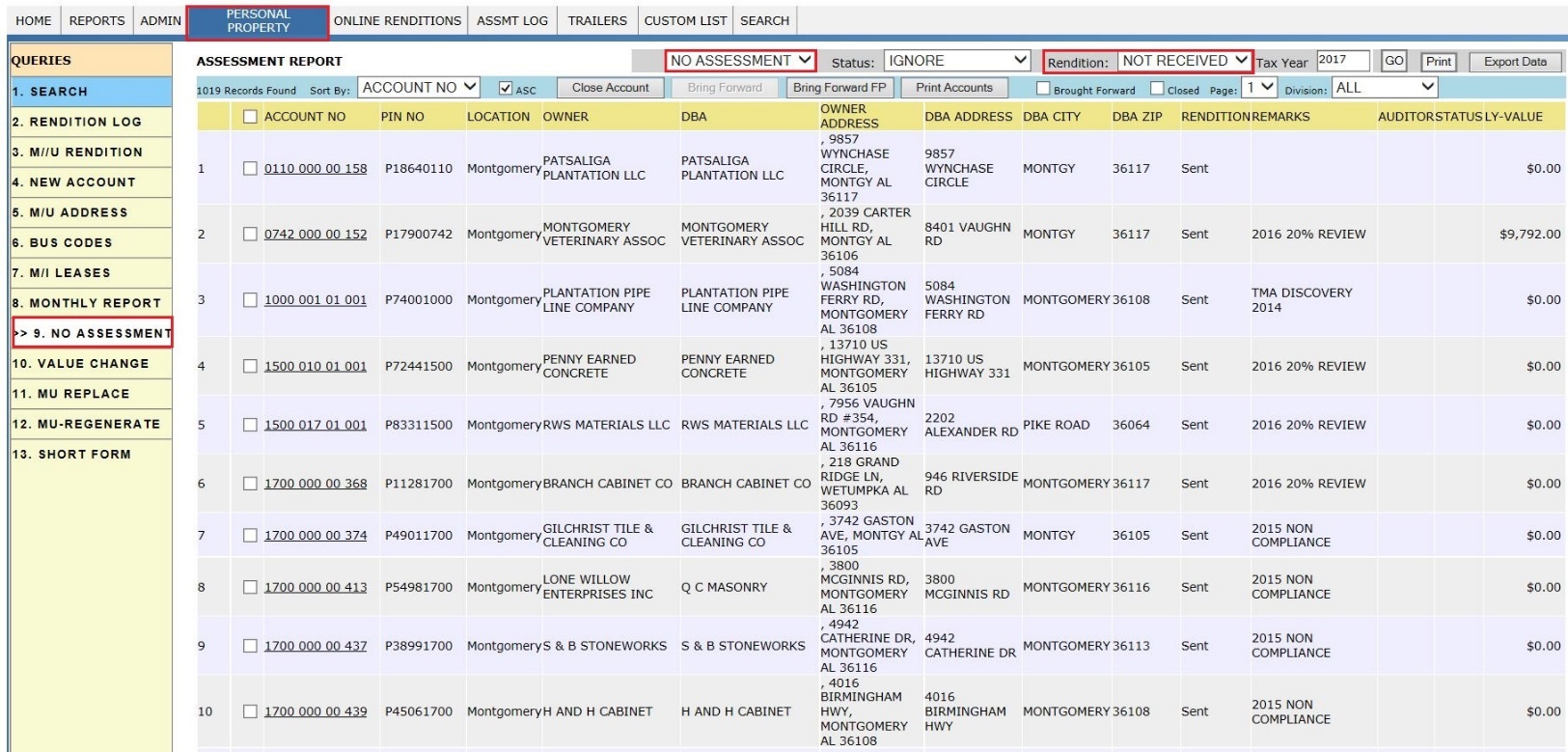

Report - 9: NO ASSESSMENT

Navigation: PERSONAL PROPERTY à NO ASSESSMENT

This Report shows Assessment Report which Includes both Assessment & No Assessment Accounts.

Rendition Not Received : When Users don’t Receive any Rendition forms from Owners, which Users take & Bring Forward using Bring Forward by selecting the Respective Accounts.

Note: If User don’t receive Renditions for which Businesses are closed, User Mass Close it.

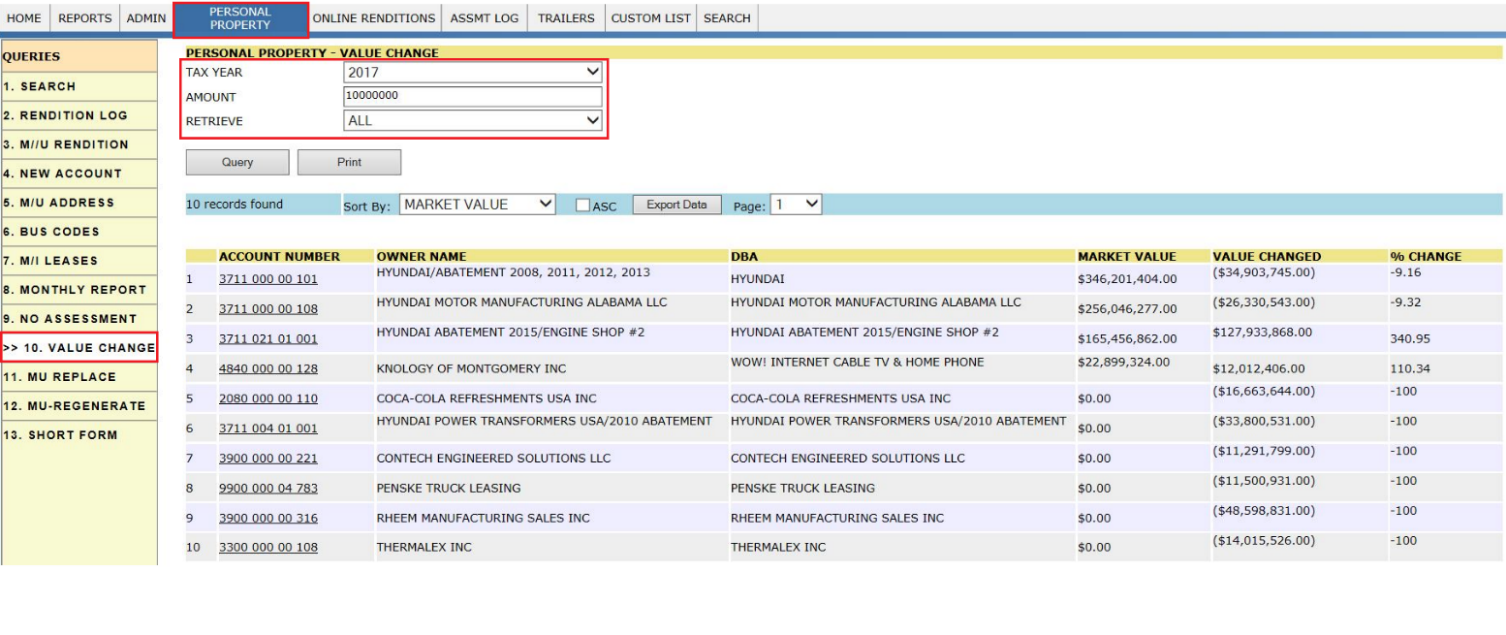

Report - 10: VALUE CHANGE

Navigation: PERSONAL PROPERTY àVALUE CHANGE

This Report shows if there is any value changed from current year to previous year based on the amount entered.

Click on Value Change tab, fill the respective details like Tax year, Amount and Retrieve and click on Query button, which shows the respective, value changed records when compared to previous year.

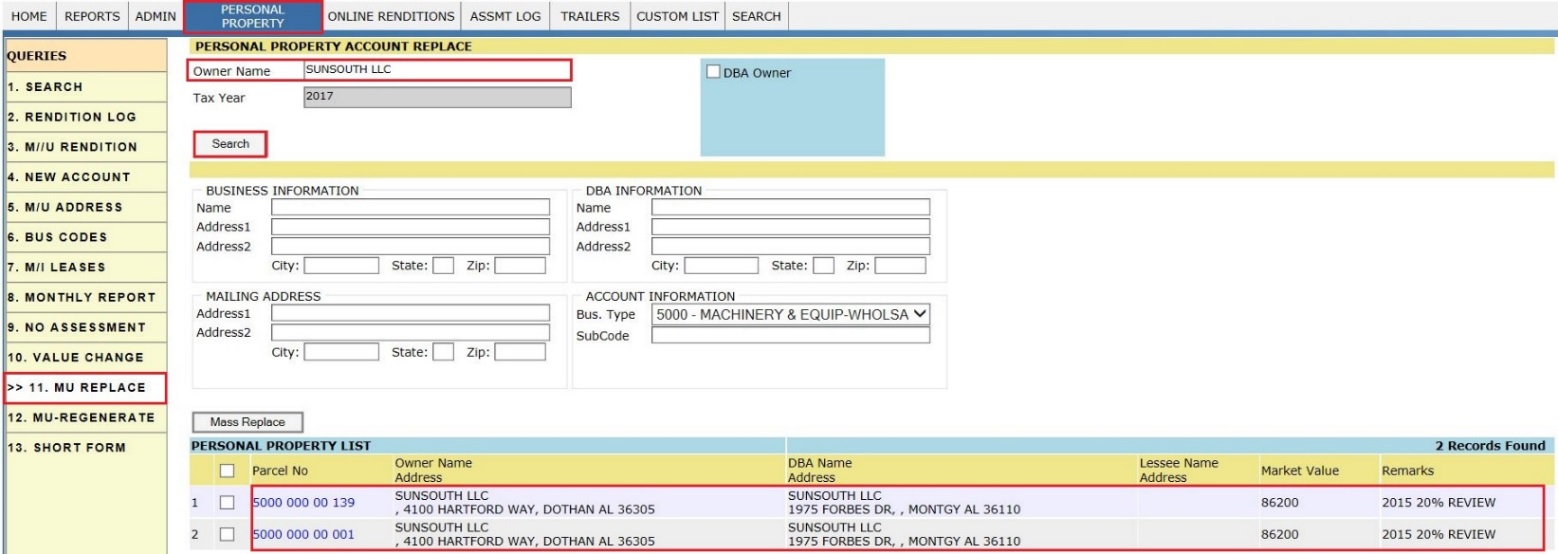

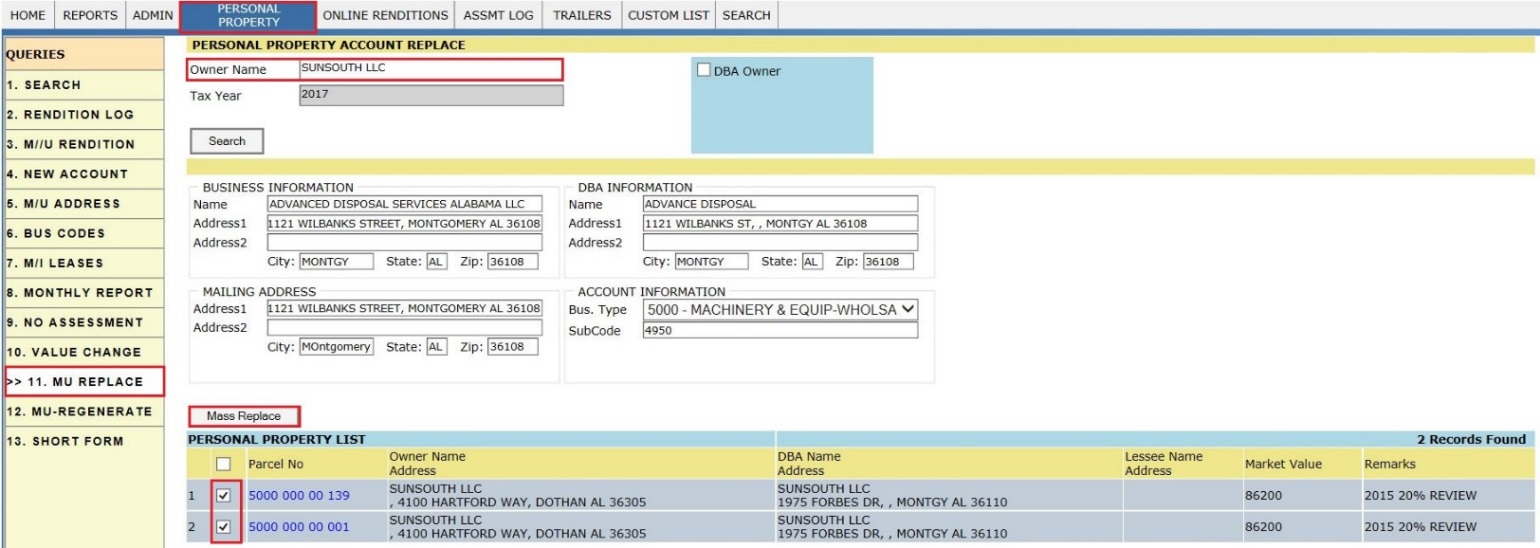

Report - 11: MU REPLACE

Navigation: PERSONAL PROPERTY à MU REPLACE

This report is used to Mass Replace the PP Accounts with respective Owner name and Tax Year.

User can Mass replace the PP Accounts by selecting the respective records & with respective details like Business, DBA, Mailing Address and Account information then click on Mass Replace.

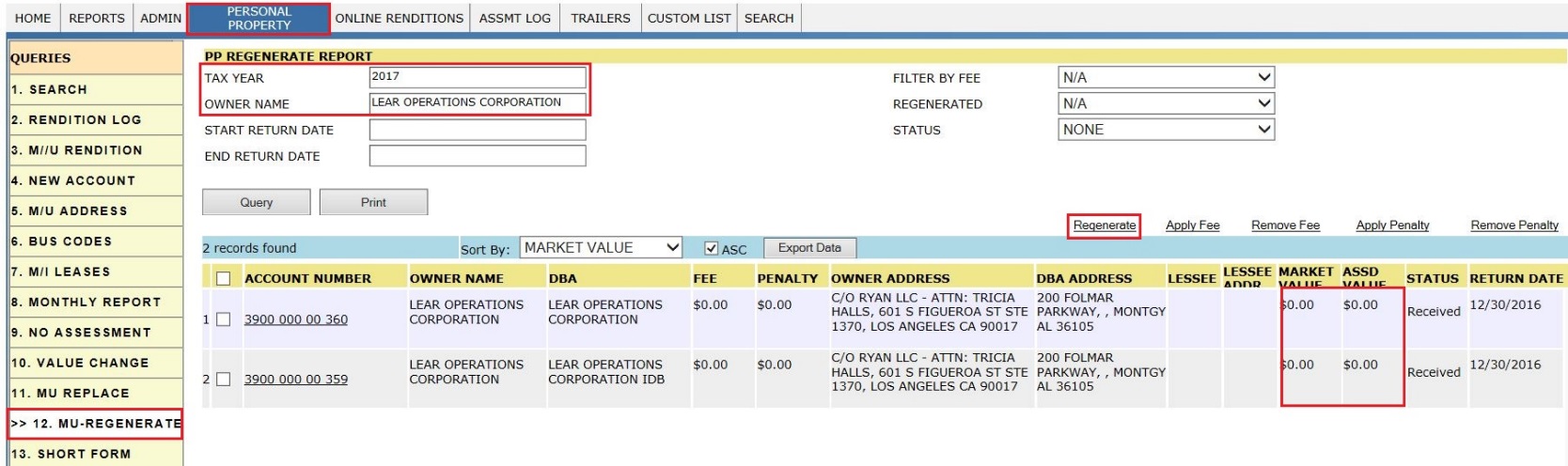

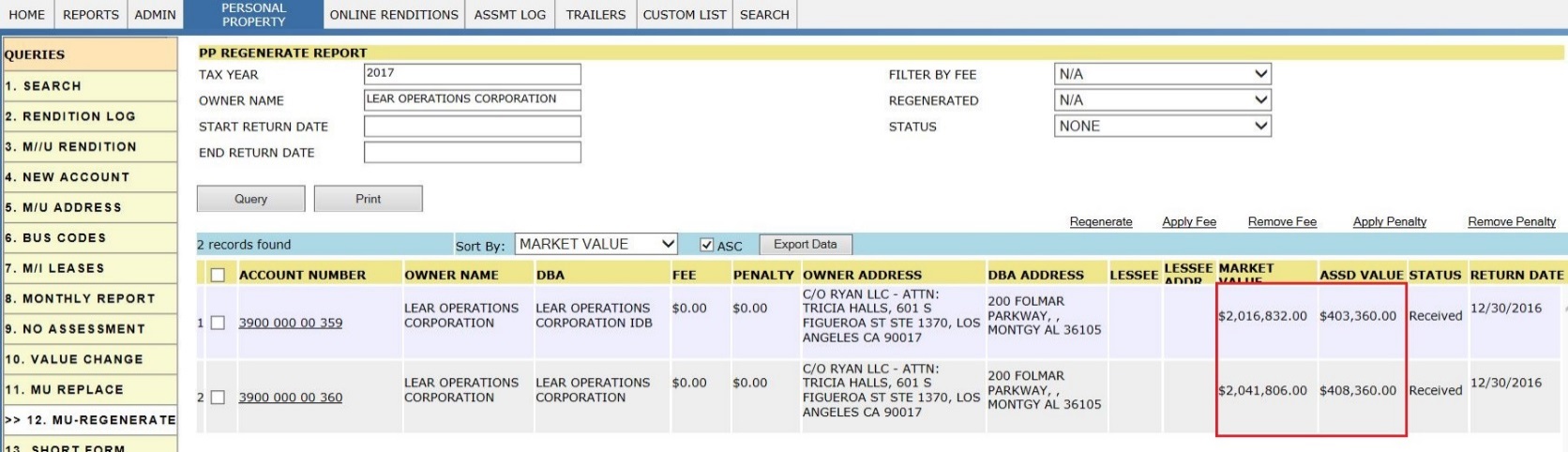

Report - 12: MU REGENERATE

Navigation: PERSONAL PROPERTY à MU REGENERATE

Once they pass Rendition deadline, based on the Filter user can apply Fee & Regenerate.

Regenerate:

This report is used to Mass Regenerate the accounts to get the new Market values.

Click on MU - REGENERATE tab, and enter the Owner details then click on Query button which gives respective Business Accounts details of that Owner details like Market Value, Assessed Value and etc.

By selecting the respective accounts to Regenerate new Mkt values based on depreciation cycle and percentage.

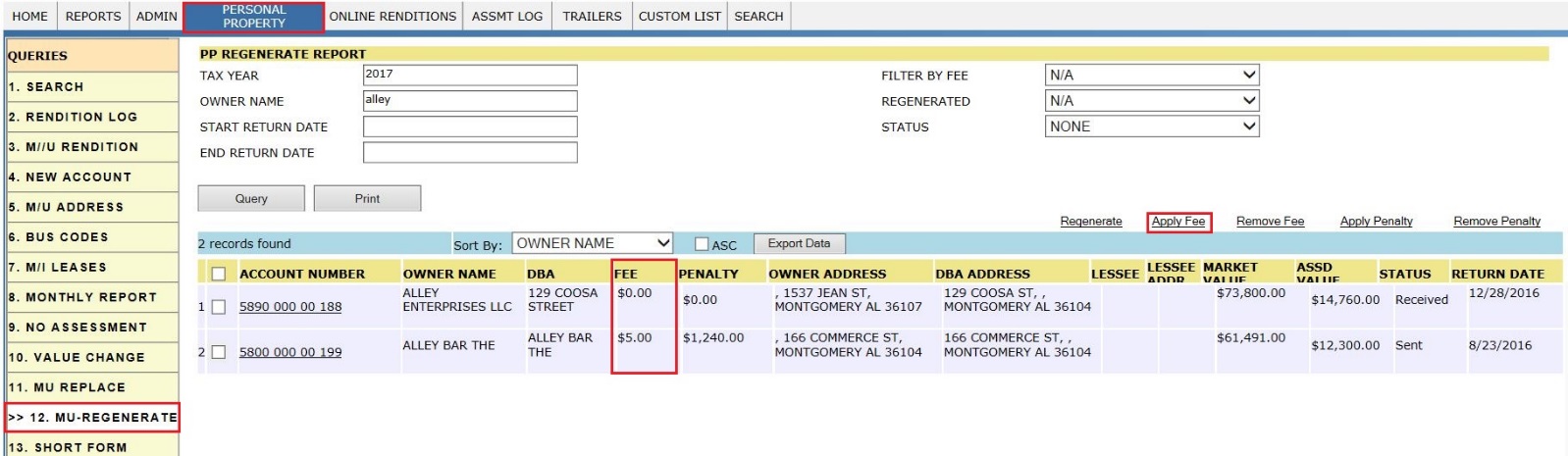

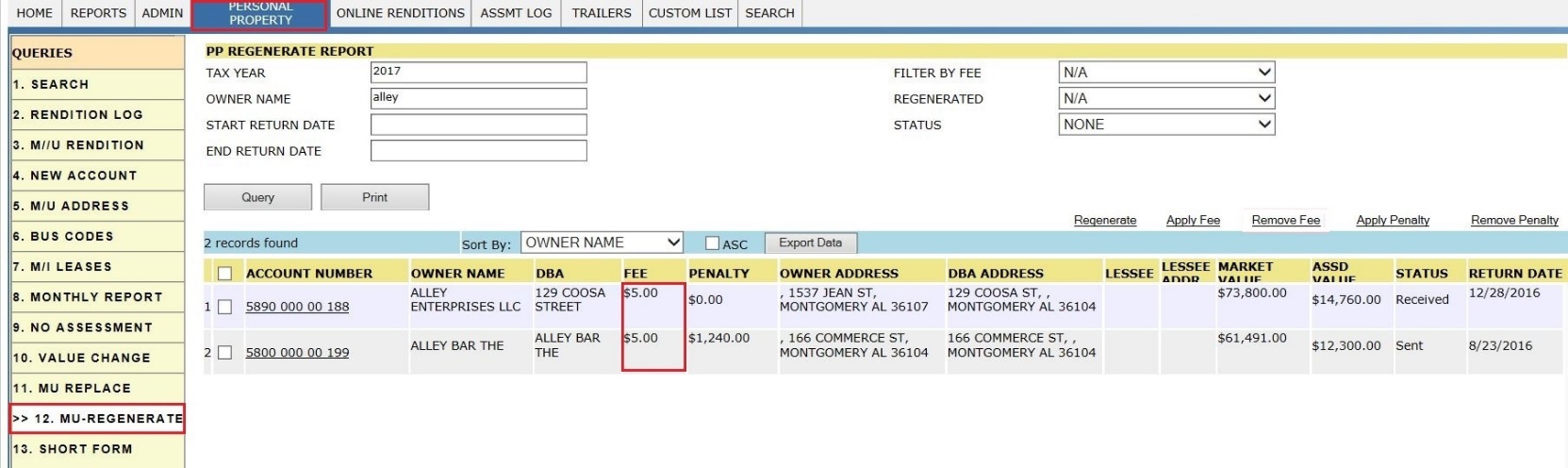

Apply Fee:

User can mass Apply fee for Late Rendition Returns. Click on Apply Fee hyper link to apply fee for the selected records.

After Applying fee.

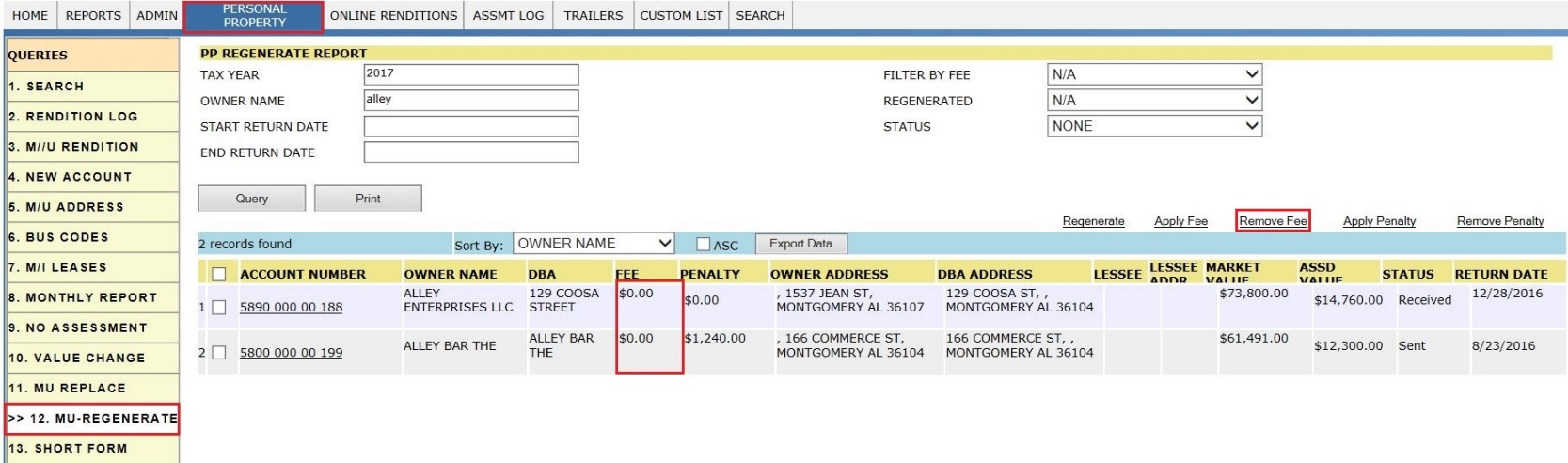

Remove Fee:

If user wants to remove penalty for selected records, then click on Remove Fee hyper link for Selected Records which will remove the applied fee.

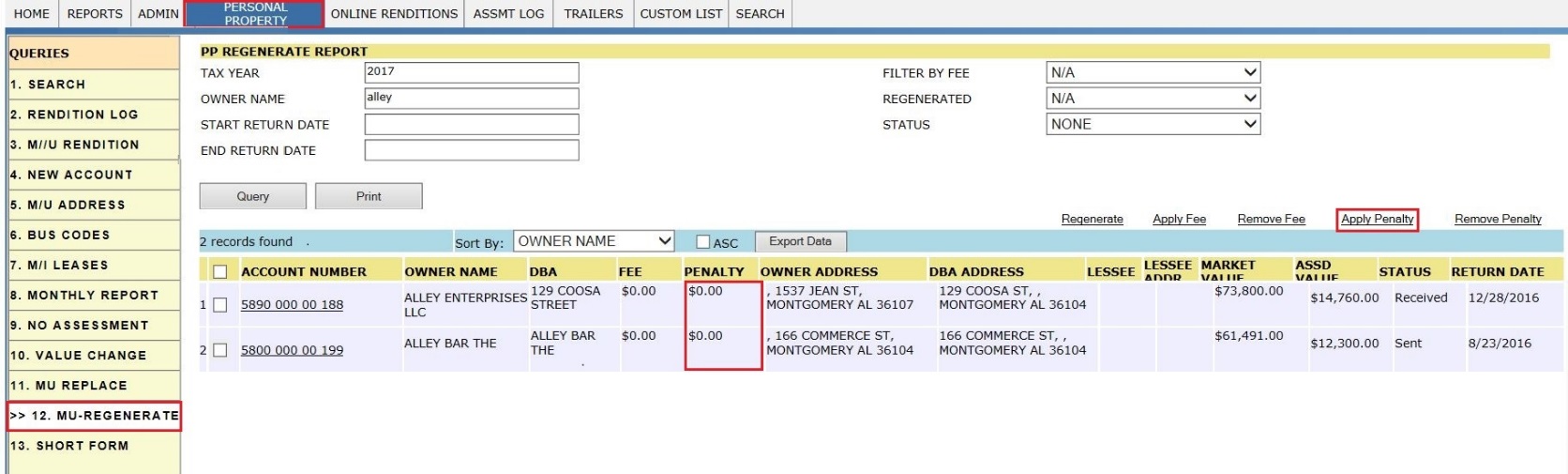

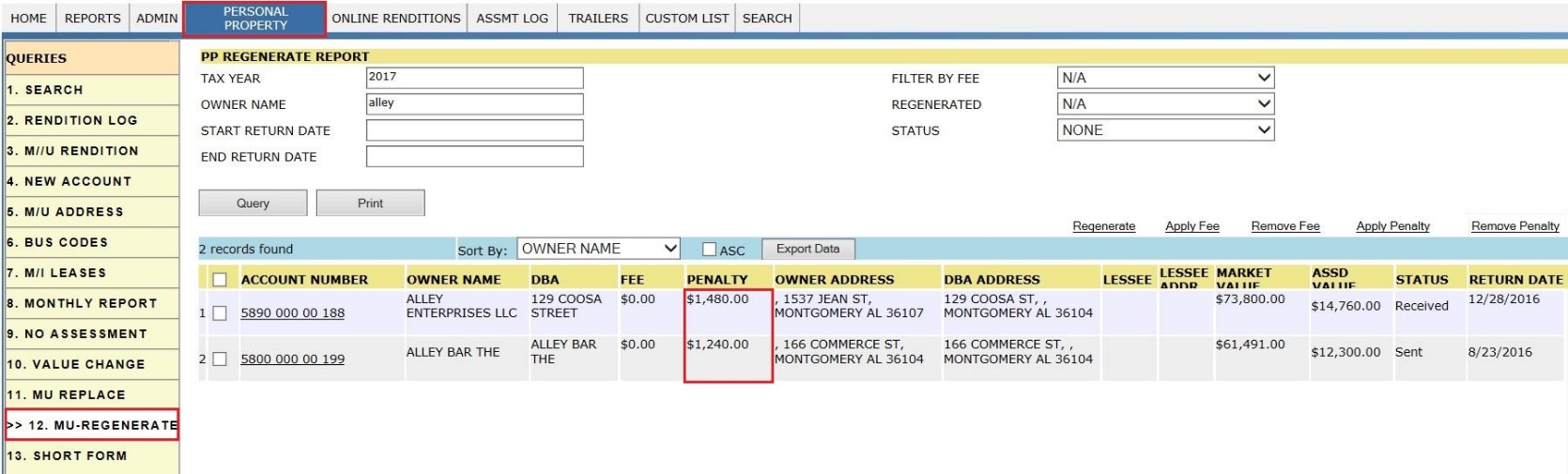

Apply Penalty:

It is used to mass apply penalty for late rendition returns of selected records, then click on Apply Penalty hyper link for Records here which will apply Penalty.

After Applying Penalty.

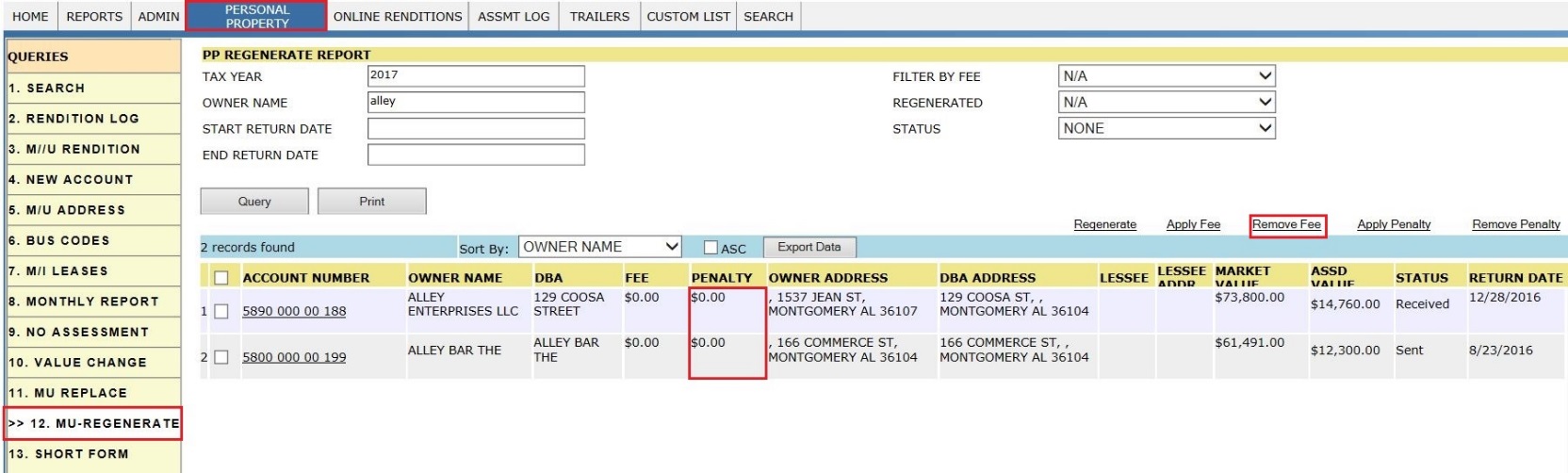

Remove Penalty:

If User wants to remove penalty for selected records, then click on Remove Penalty hyper link for Selected Records which will remove the applied penalty.

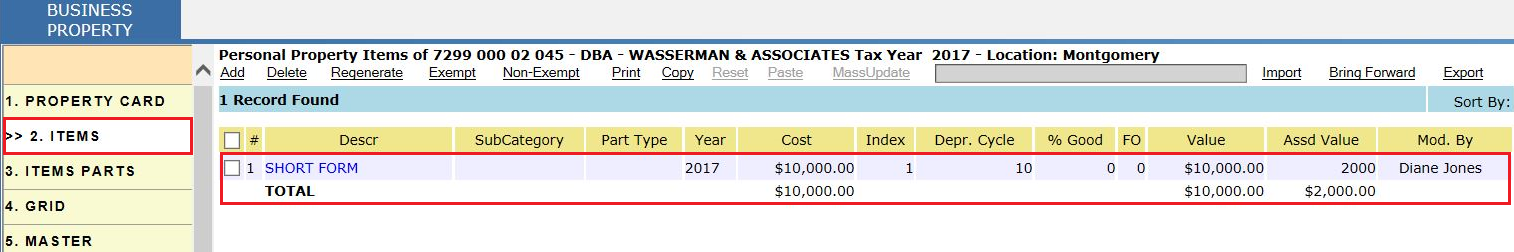

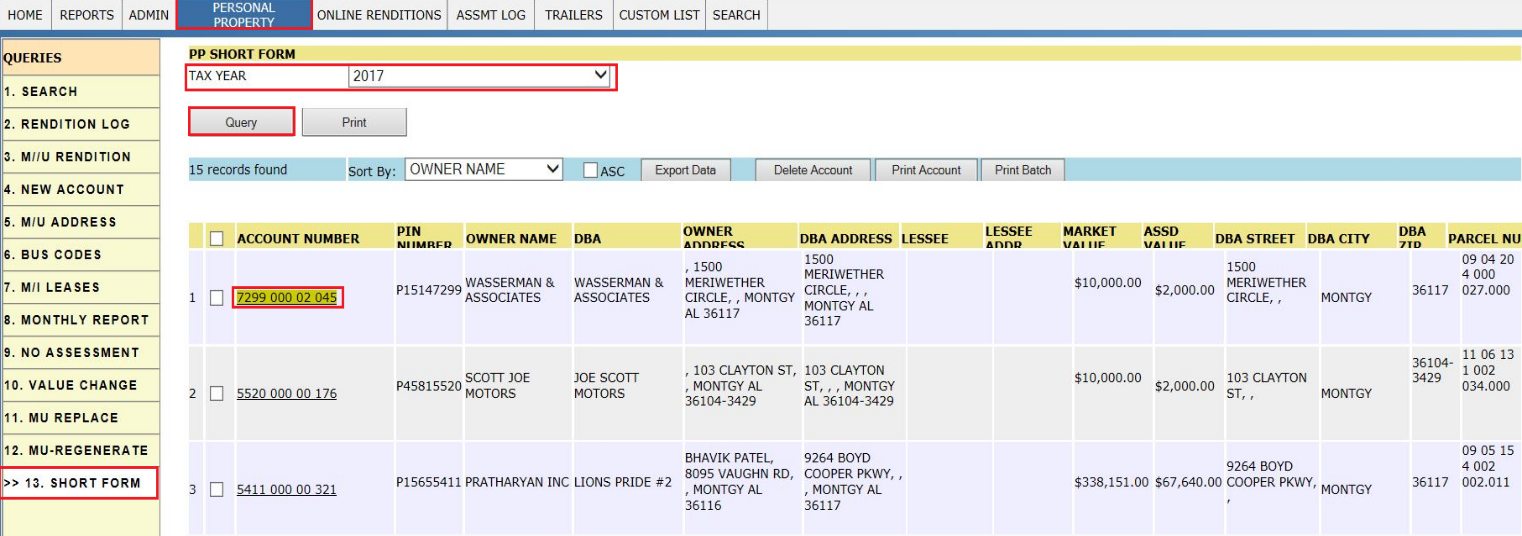

Report - 13 : SHORT FORM

Navigation: PERSONAL PROPERTY à SHORT FORM

This Report shows the Accounts which has the Item list as Short Form with respect to Tax year.

Click on Short Form tab and enter the Tax Year then click on Query which displays all the respective Accounts.

On the same page,By Clicking on Account number which redirects to Business Personal Property card.

In Business Personal Property card Page, based on County setup, short form value will be fixed. Instead of sending all the items list to the County,some businesses will send the short form and user will assess the business, based on the short form value.